Weekly News Recap 12 – 16 August 2024

News for 12 August 2024

Update on Analyst Views in the AI and Semiconductor Industry Over the Past Week

- NVDA

New Street Research has upgraded its rating on NVIDIA stock to “Buy” following a significant drop in the stock price, seeing it as an opportunity to increase investment. Despite reports that the Blackwell chips may be delayed by 3 months due to design issues, New Street remains positive about NVIDIA’s dominance in the Data Center XPU market. - INTC

Mizuho has downgraded its rating on Intel stock from “Outperform” to “Neutral” as the company continues to lag behind competitors and lose market share in all major markets, including AI, Data Centers, and PCs. The technology gap between Intel and its rivals is widening. Although there is long-term potential from Foundry and 18A, regaining leadership may be challenging. - SMCI

Bank of America has downgraded its Super Micro Computer stock rating from “Buy” to “Neutral” after the company reported lower-than-expected gross margins. Despite revenue meeting expectations and forecasts for 2025 revenue being higher than analysts had anticipated, gross margins are expected to return to normal by late 2025 gradually. - PLTR

Wedbush views the collaboration between Palantir and Microsoft to develop technology for U.S. defense and intelligence agencies as a “starting point” for expanding Palantir AIP in the public sector. - MU

Citi continues to recommend Micron as a “Top Pick” due to its strong outlook on the DRAM market. Despite a recent significant drop in semiconductor stocks, Citi remains positive about the sector, particularly regarding AI and memory strength. They forecast that DRAM prices will increase by 62% in 2024 compared to the previous year.

News for 13 August 2024

Gold Rises Amidst Middle East Tensions

On August 12, gold prices increased, closing at $2,472/oz. This rise is attributed to the growing conflict in the Middle East and the expanding Russia-Ukraine war. As a safe-haven asset, gold continues to see sustained buying pressure.

Tonight (August 13) at 7:30 PM, the U.S. Producer Price Index (PPI) will be announced, with a forecast of 0.2%, in line with the Core PPI expectation of 0.2%. ***Watch for Iran’s response following the assassination of a Hamas leader in Tehran.

WTI Oil Prices Surge by $3.22

WTI crude oil prices surged by $3.22, closing at $80.06 per barrel. This increase is anticipated to be a result of the Middle East crisis impacting oil supply. The WTI crude oil contract for September delivery rose by $3.22, or 4.2%.

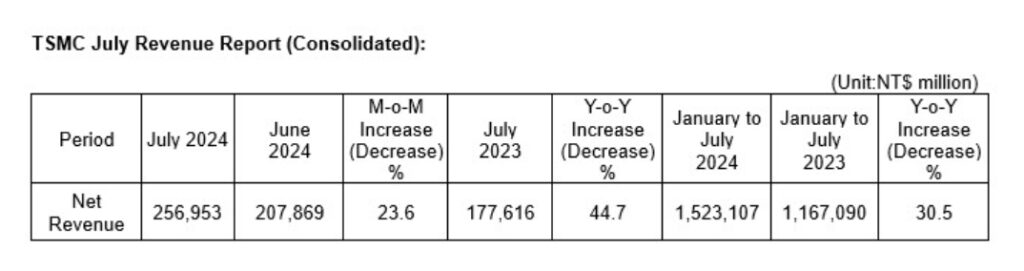

TSMC Reports Revenue Growth in July

Last week, Taiwan Semiconductor Manufacturing Company (TSMC) reported revenue for July 2024, which reached NT$256,953 million, marking a +24% MoM increase. Year-to-date (YTD) for 2024, revenue has grown to NT$1,523,107 million, representing a +31% YoY increase. Many companies are increasing their chip stockpiles amid the upcoming U.S. elections and geopolitical risks.

News for 14 August 2024

Gold Holds Steady, Eyes on $2,500/oz

On August 13, the U.S. Producer Price Index (PPI) was reported below expectations and previous levels, at 0.1%. The slowing inflation trend has eased market concerns, leading to a flow of capital back into risk assets and causing a slight profit-taking sell-off in gold.

Tonight (August 14) at 7:30 PM, the U.S. Consumer Price Index (CPI) will be announced, with a forecast of 3.0%. ***Watch for Iran’s response following the assassination of a Hamas leader in Tehran.

Kamala Harris’s Policies if Elected President of the United States

- International Trade and Trade Agreements

Harris’s views on international trade largely align with Biden’s, but one notable difference is her stance on rejoining the Trans-Pacific Partnership (TPP). The TPP, originally comprising 12 countries including the U.S., Canada, Mexico, Japan, and others, aims to enhance trade, services, and investment among its members. Harris is more inclined towards rejoining the TPP, which contrasts with Biden’s more cautious approach. - Abortion Rights

Harris takes a significantly stronger stance than Biden on supporting legal abortion access across all states. She is committed to ensuring that individuals with uteruses in the U.S. have comprehensive access to legal abortion services nationwide. - Environmental Policy and Climate Change

Harris and Biden share similar goals on environmental issues, advocating for investment in green infrastructure to transition the U.S. from fossil fuels to clean energy as quickly as possible. - AI Regulation

Harris’s approach to AI regulation is more aggressive than Biden’s. While Biden favors guidelines and standards for AI control without strict legal enforcement, Harris supports robust government oversight to protect consumers and vulnerable groups from potential AI-related risks.

News for 15 August 2024

Gold Eases as Dollar Index Strengthens

On August 14, gold prices eased, closing at $2,447/oz. This decline was due to the rebound in the U.S. Dollar Index, which rose from 102.27 to 102.56, strengthening the dollar and putting downward pressure on gold prices.

For today (August 15), at 1:00 PM, the UK’s GDP M/M will be announced, with a forecast of 0.0%. Later, at 7:30 PM, the U.S. retail sales figures are expected to be released, with a forecast of 0.4%, along with weekly jobless claims, forecasted at 236k, and the Philadelphia Fed Manufacturing Index, forecasted at 5.4.

Despite the short-term pressure on gold prices, the medium to long-term outlook remains bullish, supported by factors such as:

- The potential for the Fed to cut interest rates in September

- Geopolitical tensions

Positive Outlook: Starbucks Shares Surge 25% with New CEO Appointment

Starbucks recently announced its 3Q24 financial results (for the period ending June 30, 2024), reporting a decline in revenue to $9.114 billion, a decrease of 1% YoY. Operating income also fell to $1.518 billion, down 4% YoY, due to rising SG&A expenses, which pressured net income down to $1.055 billion, a decrease of 8% YoY.

As fixed costs, including employee wages and depreciation expenses, continue to rise amid slowing sales, Starbucks found it necessary to change its leadership. The company has appointed Brian Niccol as the new President and CEO. Niccol, who currently serves as the President and CEO of Chipotle, has a strong track record of transforming the company by focusing on people and corporate culture. Under his leadership, Chipotle nearly doubled its revenue, increased profits by almost seven times, and saw its stock price surge by nearly 800%.

This change in leadership has been positively received by investors, with Starbucks’ stock price increasing by 25% in response to the news.

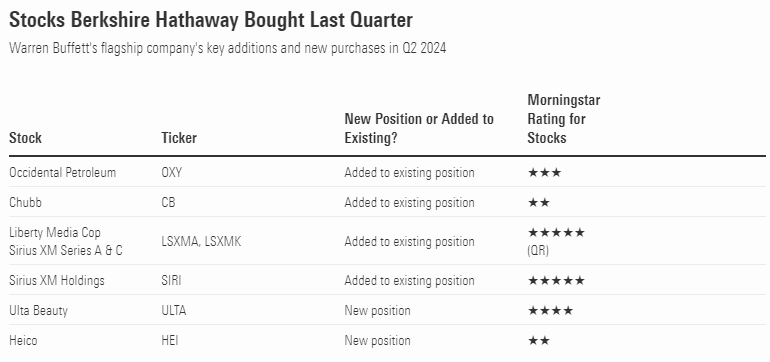

3 Stocks Warren Buffett is Accumulating

- Sirius XM Holdings (SIRI): Sirius XM Holdings is a comprehensive streaming platform offering a variety of content, including news programs. Its business model is similar to that of well-known platforms like YouTube, Spotify, Amazon Music, and Apple Music. Key highlights include its relatively low stock price and valuation. The stock is priced at $2.91, with a P/E ratio of 9, a net profit margin (NP) of 14%, and a dividend yield of 2.7%.

- Ulta Beauty (ULTA): Ulta Beauty is a major U.S. cosmetics retail brand founded in 1990. Key strengths of ULTA stock include a P/E ratio of 15.50, a return on assets (ROA) of 23%, and a return on equity (ROE) of 58%, with a debt-to-equity ratio (D/E) of less than 1.

- Heico Corporation (HEI): Heico Corporation operates in the aviation and defense sectors. A significant strength is its consistent double-digit revenue and profit growth over the past seven quarters. However, a notable weakness is its high P/E ratio of around 75.

News for 16 August 2024

Gold Holds Steady at the End of the Week

On August 15, gold prices rebounded, closing at $2,456/oz, driven by escalating tensions in the Middle East. As a safe-haven asset, gold saw continued buying interest.

Tonight (August 16) at 7:30 PM, the U.S. housing starts data is set to be released, with a forecast of 1.43 million. Later at 9:00 PM, the University of Michigan Consumer Sentiment Index will be announced, with a forecast of 66.

Walmart Reports Earnings and Revenue

Walmart reported its earnings and revenue for May through July, which corresponds to the second quarter of the company’s fiscal year. The results exceeded analysts’ expectations, driven by strong performance in the e-commerce segment. The company reported earnings per share of 67 cents, surpassing the analysts’ forecast of 65 cents per share, and revenue of $169.34 billion, which was higher than the expected $168.63 billion.