Weekly News Recap 7 – 11 October 2024

News for 7 October 2024

Gold Edges Lower

At the end of last week, gold prices dipped, closing at $2,653/oz. This was driven by stronger-than-expected U.S. non-farm payrolls and unemployment data, which came in at 254,000 jobs and 4.1%, respectively. Additionally, the U.S. Dollar Index strengthened to 102.48, adding further pressure on gold prices.

It is anticipated that the U.S. economy may experience a “soft landing,” which could lead to more funds flowing into riskier assets. However, gold prices will continue to be influenced by the geopolitical tensions in the Middle East and their potential impact going forward.

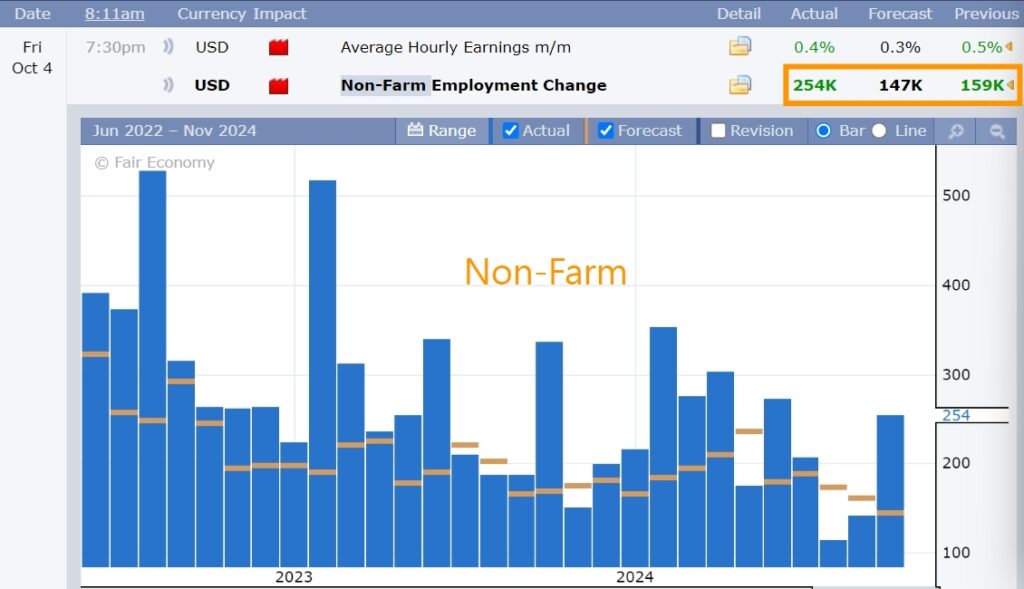

U.S. Job Growth Soars in September, Reaches 6-Month High

U.S. employment surged in September, with the Department of Labor reporting on Friday that non-farm payrolls increased by 254,000 jobs. This marks the highest gain in six months and surpasses analysts’ expectations of 147,000 jobs. This comes after a 159,000-job increase in August.

WTI Oil Rises 0.9% on Middle East Conflict Concerns

WTI crude oil for November delivery rose by 67 cents, or 0.9%, to close at $74.38 per barrel. The weekly gain marked the largest increase in over a year, driven by growing concerns over the impact of the ongoing Middle East conflict. However, the price rally was capped by U.S. President Joe Biden’s warning to Israel to avoid targeting Iran’s oil facilities.

Gold Prices Could Reach 45,000 THB Amid Middle East Conflict

Anusorn Tamajai, Dean of the Faculty of Economics at the University of Thai Chamber of Commerce, stated that gold prices are likely to experience volatility, potentially rising and falling multiple times within a single day. However, if the Middle East conflict continues to escalate, there is a possibility that global gold prices could test $2,700 per ounce in the near future and may surge to 45,000 THB per baht of gold in the long term if the conflict widens.

Additionally, investments in risk assets remain uncertain and highly volatile due to strong U.S. employment figures, which may delay interest rate cuts. The stronger dollar is also pressuring gold prices. However, if the Federal Reserve reduces interest rates by only 0.25% in its November meeting, the Dollar Index could rise slightly, exerting short-term pressure on gold. Over the long term, the dollar is expected to weaken, providing opportunities for gold to continue rising.

News for 8 October 2024

Gold Softens as U.S. Bond Yields Rise

On October 7, gold prices declined, closing at $2,642 per ounce. This drop was driven by the rise in U.S. 10-year Treasury yields, reaching 4.0%, prompting investors to sell gold, which offers no interest or yield.

It is expected that gold prices are entering a sideways-down movement.

Hurricane Impacts U.S. Economy: Growth Slows, Costs Rise

After Hurricane Helene hit six U.S. states, causing over 200 fatalities, the U.S. economy faced significant damage. Key sectors, including infrastructure, manufacturing, and transportation, were affected, leading to a slowdown in economic growth. The recovery is expected to take time and result in higher financial and insurance costs. Additionally, prices for some goods may rise due to increased demand. Meanwhile, Hurricane Milton is expected to impact the U.S. later this week.

Goldman Sachs Lowers U.S. Recession Forecast Following Strong Employment Data

Jan Hatzius, Chief Economist for Goldman Sachs, stated that the September employment report has “changed the outlook for the labor market,” alleviating concerns about a potentially premature slowdown in labor demand that could lead to an unavoidable rise in unemployment rates. He also predicts a continued reduction in interest rates by 0.25% until they reach a range of 3.25-3.5% by June next year.

This adjustment has led Goldman Sachs to lower its forecast for the likelihood of a U.S. recession in the next 12 months by 5%, bringing it down to just 15%.

Halifax Reports UK House Prices Surge in September 2023, Highest Since November 2022

According to Reuters, Halifax data shows UK house prices rose by 4.7% year-on-year in September, a slight increase from 4.3% in August but lower than analysts’ expectations of a 5.2% rise.

On a monthly basis, house prices rose 0.3%, matching the increase seen in August. However, this figure fell short of the 0.4% rise expected by most economists in a Reuters poll.

Many economists in the poll expect the Bank of England (BoE) to lower interest rates at its next meeting in November, after keeping rates at 5% in its previous meeting.

News for 9 October 2024

Gold Weakens Amid Ceasefire Hopes

Gold prices dropped sharply, closing at $2,621/oz due to expectations that Hezbollah and Israel may reach a ceasefire agreement. This led to a sell-off in gold, traditionally considered a safe-haven asset.

Additionally, the upcoming release of the U.S. FOMC meeting results at 1:00 AM on October 9th may impact gold’s movement, with indications that the precious metal is beginning to lose its current stability.

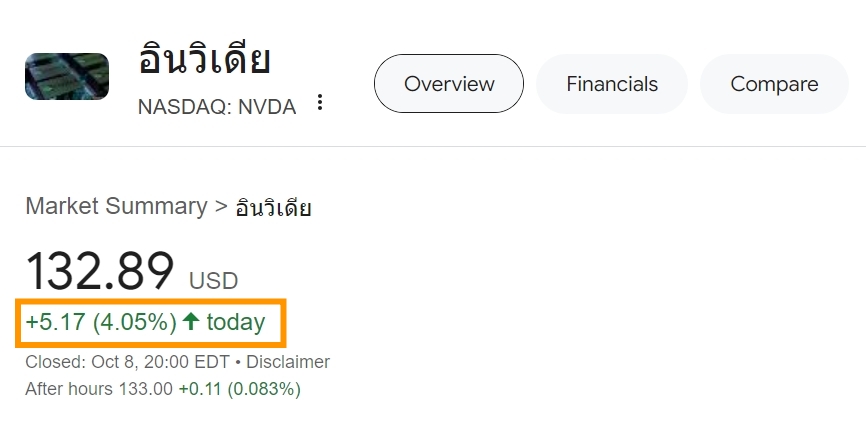

“Magnificent Seven” Stocks Surge Led by NVIDIA

The “Magnificent Seven” stocks saw strong gains, with NVIDIA leading the charge with a 4.1% increase, marking its strongest single-day rise in a month. Microsoft rose by 1.2%, Apple surged 1.8%, Alphabet climbed 0.8%, Amazon jumped 1.06%, Tesla advanced 1.5%, and Meta Platforms added 1.4%.

News for 10 October 2024

Gold Drops Sharply as the Dollar Index Rises

On October 9, gold prices fell to $2,607/oz, driven by a sharp increase in the Dollar Index, which rose from 102.42 to 102.87, putting pressure on gold.

On October 10 at 7:30 PM, the U.S. Consumer Price Index (CPI) for September will be announced, with expectations set at 2.3%.

It is anticipated that gold prices will continue to move sideways with a downward bias.

Alphabet Drops 1.5%

Alphabet shares closed 1.5% lower following reports that the U.S. Department of Justice may file a court petition to force the company, Google’s parent, to divest some of its businesses. This includes the Chrome browser and Android operating system, as the DOJ believes Google has used these to monopolize the online search market.

News for 11 October 2024

Gold Rebounds, Faces Key Resistance

On October 10, gold prices rebounded to $2,630/oz following a U.S. inflation report for September that came in higher than expected at 2.4%, though slightly lower than the previous 2.5%.

On October 2 at 7:30 PM, the U.S. Producer Price Index (PPI) was announced with a forecast of 0.1%. However, the rebound in gold prices is expected to be limited as it approaches key resistance levels.

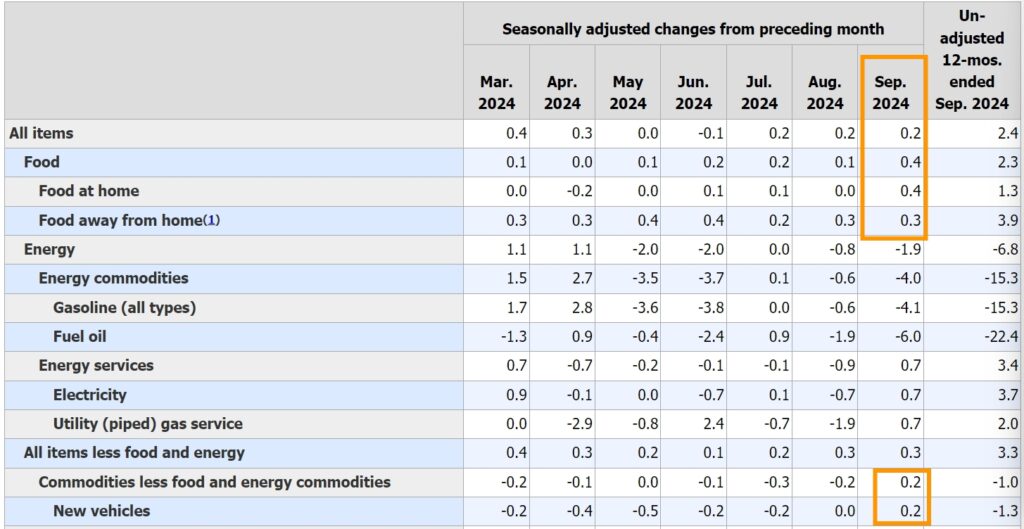

U.S. Inflation Holds Steady in 2.4%-2.5% Range, Driven by Services and Oil Prices

U.S. inflation remains under pressure, primarily from the services sector, especially food and transportation costs. Inflation for October is expected to stay within the 2.4%-2.5% range, partly due to the delayed impact of oil prices on service sector goods. The effect of oil price fluctuations on inflation is typically slower to reflect, which could keep inflation at similar levels as seen in recent months.

- Food and Transportation: These categories within services contribute the most to inflation due to rising production and transportation costs linked to high oil prices.

- Inflation Outlook: Despite the continued high costs of oil and transportation, the inflation rate is expected to stabilize within the 2.4%-2.5% range in October, without significant short-term pressure from the services sector.

- Impact on Fed Policy: The steady inflation rate may alleviate concerns about a rapid interest rate hike by the Federal Reserve. Market participants will likely focus on upcoming interest rate decisions, monitoring the Fed’s response to the current inflationary environment.

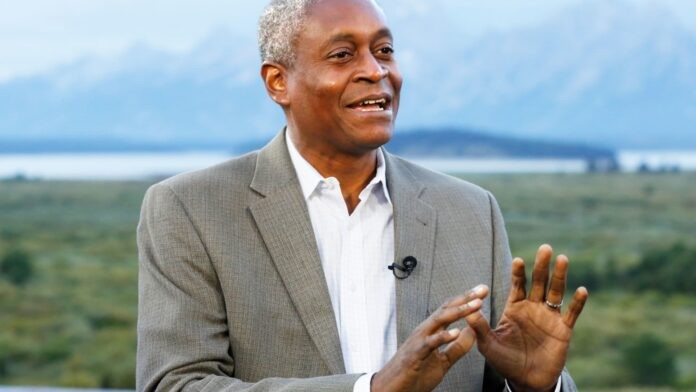

Bostic Supports Fed Keeping Interest Rates Unchanged in November Meeting

Raphael Bostic, President of the Atlanta Federal Reserve, recently expressed his support for the Federal Reserve to keep interest rates unchanged at the upcoming November meeting. This comes after recently released inflation and employment data showed volatility, reflecting continued uncertainty in the economy. Bostic pointed out that while previous rate hikes have helped ease some inflationary pressures, the current volatility in the data is not sufficient to justify another rate increase at this time.

He further added that the Fed still needs to monitor additional economic data to effectively assess long-term inflation trends and economic growth. He emphasized that future decisions must carefully balance controlling inflation with supporting economic growth.