Weekly News Recap 26 – 30 August 2024

News for 26 August 2024

Gold Prices Surge, Poised to Hit $2,700/oz by Year’s End

At the end of last week, the price of gold rose to close at $2,512/oz, driven by comments from Jerome Powell that reinforced expectations of a Fed interest rate cut in September. The market has become more relaxed, and the dollar index has weakened from 101.55 to 100.67, further supporting the rise in gold prices.

On August 26, U.S. durable goods orders are expected to be announced, with a forecast of 4.0%. Later, at 8:00 PM, key economic indicators will be released.

Overall, the trend for gold prices remains bullish, supported by fundamental factors.

IMF Announces BOJ May Gradually Raise Interest Rates

The International Monetary Fund (IMF) has revealed that the Bank of Japan (BOJ) can gradually increase interest rates. The IMF’s forecast of rising inflation allows the BOJ to shift from its highly accommodative monetary policy towards a more normalized stance.

News for 27 August 2024

Gold Holds Steady Ahead of Core PCE Announcement Later This Week

On August 26, gold prices slightly declined, closing at $2,518/oz. This dip was attributed to investors reducing their positions ahead of NVIDIA’s earnings report due tomorrow night, anticipating potential volatility. Consequently, funds flowed into the dollar, causing the dollar index to rise to 100.85 and putting pressure on gold prices.

On August 27, at 9:00 PM, the U.S. consumer confidence index will be announced, with a forecast of 100.9. At the same time, the Richmond Fed manufacturing index is expected to report -14.

Gold prices are currently in a “sideways up” pattern, with support at $2,500/oz and resistance at $2,530/oz.

TSLA Drops 3.2%

Tesla shares fell over 3.2% after the Canadian government announced a 100% import tax on electric vehicles (EVs) from China. This move aligns with similar actions taken by the United States and the European Union (EU).

Boeing (BA) Stock Drops 0.85%

Boeing shares fell 0.85% following NASA’s decision to use SpaceX’s spacecraft, developed by Elon Musk, instead of Boeing’s Starliner for astronaut returns to Earth next year.

News for 28 August 2024

Gold Holds Steady at Elevated Levels

On August 27, gold prices rose to close at $2,524/oz, driven by a weakening dollar index, which fell from 100.89 to 100.51. This decline in the dollar index supported the increase in gold prices.

Looking ahead to August 28, NVIDIA’s earnings report is expected to influence both equity and financial markets, potentially introducing volatility due to the significant size of the company.

Eli Lilly Expands Again: Prepares to Launch a New Version of Weight Loss Drug Zepbound

Eli Lilly has announced the launch of a new version of Zepbound at half the usual monthly price. The latest product is priced at $399 per month for the 2.5 mg dose and $549 per month for the 5 mg dose, significantly lower than the regular price of $1,000 per month for the original product.

This new version comes in single-dose vials of 2.5 mg and 5 mg. Patients need to draw the medication directly from these vials using a syringe and needle. Typically, an autoinjector pen is used, allowing precise dosing with a single push of a button for all Zepbound dosages.

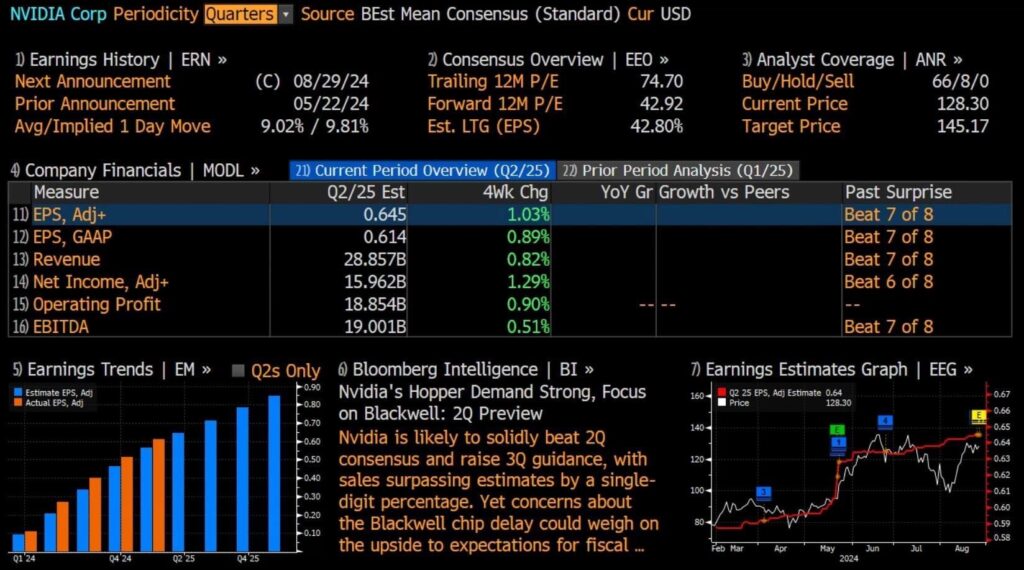

NVIDIA (Preview) Q2 2024: Expected Growth YoY and QoQ

As of August 7, NVIDIA (NVDA) shares hit a low of $98 due to negative sentiment surrounding U.S. tech stocks, with core business segments of companies like Apple and Google showing signs of weakening. This has put pressure on NVIDIA, which had not yet reported earnings.

However, over the past five days, NVDA shares have risen approximately 15%. This increase is attributed to anticipated strong earnings for Q2 2024, with expected revenue of $28.6 billion, up 112% YoY and 10% QoQ, and earnings per share (EPS) rising to $0.64, an increase of 137% YoY and 5% QoQ. This growth is driven by a continued increase in data-related revenue, which accounts for 80% of total revenue, and a projected stable net profit margin above 56%.

Analysts have set a 2024 target price of $140, implying a P/E ratio of 78. If Q2 2024 results meet expectations, the diluted P/E ratio could decrease to 65, potentially leading to an upward adjustment in the target price.

News for 29 August 2024

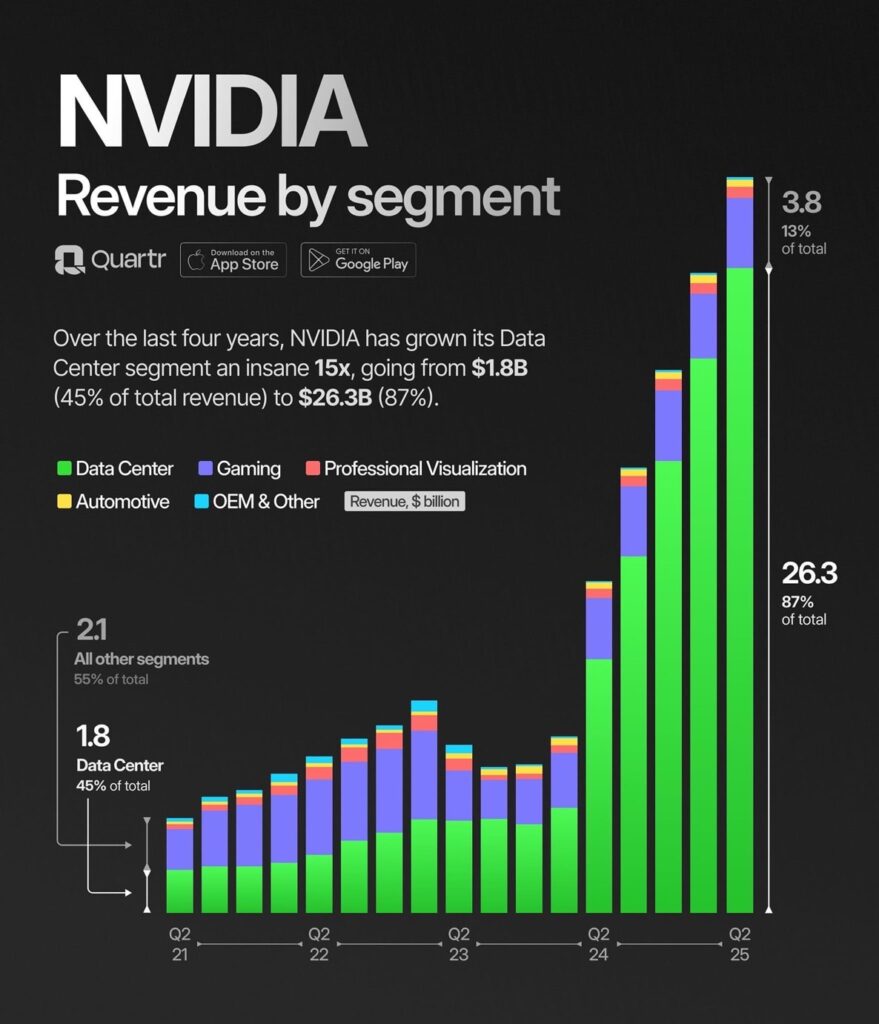

NVIDIA Q2 Results Exceed Expectations, Yet Stock Falls 6%

NVIDIA’s stock dropped 6% in after-hours trading on Wednesday, despite the company surpassing earnings expectations for Q2 and offering an optimistic outlook for the next quarter.

Q2 Results:

- Earnings Per Share (EPS): $0.68, exceeding the expected $0.64

- Revenue: $30 billion, up 122% YoY

- Data Center Revenue: $26.3 billion, above the forecast of $25.08 billion

- Automotive Revenue: $346 million

- Professional Visualization Revenue: $454 million, up 20% YoY

Q3 Outlook:

- Expected Revenue: $32.5 billion (+/- 2%), compared to the analyst estimate of $31.71 billion

- Gross Margins: Projected at 74.4% GAAP and 75.0% Non-GAAP

- Operating Expenses: Expected to be around $4.3 billion GAAP and $3.0 billion Non-GAAP

- Other Income: Expected at approximately $350 million

- Tax Rate: Estimated at 17% GAAP and Non-GAAP

Additional Insights:

- CEO Jensen Huang highlighted strong demand for Hopper chips and high expectations for Blackwell chips, with sample shipments already underway.

- Despite robust Q2 results and strong forecasts for Q3, NVIDIA’s guidance remains slightly below the highest Wall Street expectations.

- NVIDIA continues to lead in the AI chip market, with anticipated significant revenue from Blackwell chips in Q4.

The decline in NVIDIA’s stock post-earnings reflects broader market reactions, including declines in other semiconductor stocks such as AMD, ARM, ASML, TSMC, and Intel, as well as Super Micro Computer (SMCI).

Gold Prices Decline as NVIDIA Misses Q3 Expectations

On August 28, gold prices fell to close at $2,504/oz due to the strengthening of the dollar index, which rose from 100.53 to 101.03, putting downward pressure on gold prices.

On August 29, at 7:30 PM, the U.S. GDP data and weekly jobless claims figures are set to be released, with forecasts of 2.8% GDP growth and 232k jobless claims.

The dollar index may continue to strengthen as the sell-off in NVIDIA shares leads investors to shift more towards holding dollars.

News for 30 August 2024

Gold Rises on Fed Rate Cut Hopes

On August 29, gold prices increased to close at $2,521/oz, driven by expectations that the Federal Reserve might cut interest rates by 0.25% in September. For the year 2024, the Fed is anticipated to reduce rates by at least 0.5%, which has supported the rise in gold prices.

On August 30, at 7:30 PM, the U.S. personal consumption expenditures (PCE) price index is set to be released, with a forecast of 0.2%.

The outlook for gold prices remains bullish, with the current trend indicating upward momentum.

NVDA Decline Viewed as Opportunity

Despite NVIDIA (NVDA) stock dropping on August 29, it is seen as an opportunity. There may be surprises related to Blackwell issues towards the end of 3Q24 or into 4Q24. Additionally, the company’s 3Q24 revenue outlook, estimated at $32.5 billion, exceeds analyst expectations, suggesting a positive trend.

AAPL Shares Rise on Potential Collaboration with OpenAI

On August 29, Apple (AAPL) shares rose 1.46% to close at $229, following reports from The Wall Street Journal that OpenAI is seeking new investment to raise its valuation above $100 billion. Apple and NVIDIA are among the companies interested in investing in OpenAI.

If Apple decides to invest in OpenAI, it would mark a significant commitment to artificial intelligence services. Previously, Apple launched Apple Intelligence, which currently integrates only OpenAI’s ChatGPT.

NVIDIA, which has invested in various AI companies such as Inflection AI and Databricks, is also a major client of OpenAI, utilizing NVIDIA chips for processing.