Weekly News Recap 23 – 26 July 2024

News for 23 July 2024

Gold Breaks Key Support Level, Expected to Fluctuate in a Narrow Range

On July 22, the price of gold weakened and closed at $2,396/oz due to profit-taking pressure and the lack of new supportive factors. As a result, funds flowed back into risky assets, putting further pressure on the gold price.

On July 23 at 9:00 PM, the figures for existing home sales and the Richmond Manufacturing Index will be announced, with forecasts of 3.99M and -7, respectively.

NVIDIA Adjusts Strategy to Compete

Reuters reported that NVIDIA is developing another version of its flagship Blackwell AI chips. This special version complies with U.S. export control measures, enabling it to be sold in the Chinese market.

The new processors combine two silicon wafers, each the size of previous products. In this series, the B200 model is 30 times faster than its predecessor in certain tasks, such as answering questions from a chatbot.

The U.S. tightened export controls on semiconductor chips to China in 2023 to prevent China from advancing in supercomputing, which could benefit the Chinese military. Since then, NVIDIA has developed three types of chips specifically for the Chinese market.

However, U.S. export controls have allowed Huawei and startups like Enflame, backed by Tencent, to gain a larger share of the advanced AI processor market in the country.

News for 24 July 2024

Gold Caution on Acceleration

On July 23, the price of gold rebounded, closing at $2,409/oz. This was due to the dollar index rebounding from 104.30 to 104.46. The strengthening dollar supported the rise in gold prices.

On July 24 at 8:45 PM, the U.S. Manufacturing and Services PMI figures will be announced, with forecasts of 51.7 and 54.7, respectively.

Tesla’s 2Q24 Earnings: Revenue Growth, But Lower EPS

On July 23, Tesla reported its 2Q24 earnings with a revenue of $25.5 billion, a 2% increase YoY and a 20% increase QoQ. The breakdown is as follows: automotive sales were $19.878 billion, down 7% YoY but up 14% QoQ; energy generation and storage revenue was $3.014 billion, up 100% YoY and 84% QoQ; and services revenue was $2.608 billion. The operating margin slightly recovered from 5.5% in 1Q24 to 6.3%. However, earnings per share (EPS) fell to $0.52, below the forecast of $0.61. This decline was due to increased financial costs, lower other income, and relatively low gross margins in energy generation and storage and service revenues.

Tesla shares (TSLA) fell by 2% because, although revenue is beginning to recover, the proportion of revenue from automotive sales has decreased from 97% to 78%. Meanwhile, revenue from energy generation and storage has almost doubled. The market was disappointed, leading to selling pressure.

News for 25 July 2024

Gold Weakens, Breaking Key Support Level

On July 24, the price of gold weakened, closing at $2,397/oz. This was due to the U.S. Services PMI coming in higher than expected at 56.0. As a safe-haven asset, gold faced selling pressure.

On July 25 at 7:30 PM, the U.S. GDP and weekly jobless claims figures will be announced, with forecasts of 2.0% and 237k, respectively.

Google’s 2Q24 Revenue and Profit Grow Well, but YouTube Revenue Declines

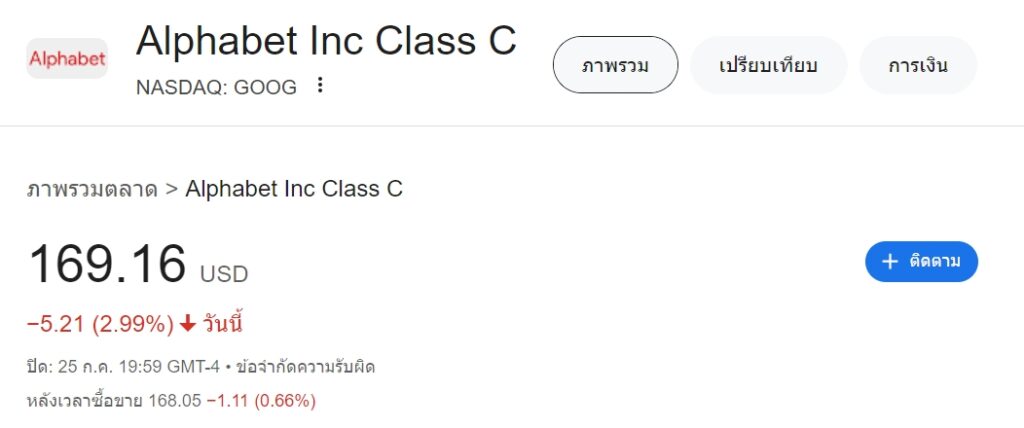

On July 24, Google (GOOG) reported its 2Q24 earnings. Revenue increased to $84.7 billion, up 14% YoY and 5% QoQ, with earnings per share (EPS) rising to $1.89, up 13% YoY. This was driven by a significant rise in Google Advertising revenue, which increased to $64.6 billion, up 11% YoY (compared to the forecast of $64.2 billion). Operating margin improved to 32% from 29% in 2Q23.

However, last night (July 24), GOOG shares fell by more than 4% due to YouTube revenue coming in below expectations, at $8.6 billion (forecasted at $8.95 billion). Management, however, remains optimistic about the company’s growth prospects, particularly in Cloud and AI, anticipating continued revenue growth.

This movement is considered to be market sentiment, as tech stocks have generally declined sharply, especially Tesla, which fell by more than 12%. GOOG shares have risen by 24% YTD, resulting in a P/E ratio of 27 times, higher than the historical average of 25 times.

News for 26 July 2024

Gold Rebounds at Support Level

On July 25, the price of gold weakened, closing at $2,364/oz. This was due to the U.S. 2Q GDP figures coming in higher than expected at 2.8%, combined with the dollar index rising to 104.39. The strengthening dollar pressured gold prices.

On July 26 at 7:30 PM, the U.S. Core PCE Inflation Index will be announced, with a forecast of 0.2%.

GOOG Declines – Viewed as Market Sentiment Despite Strong Core Revenue Growth

Alphabet shares fell 3.1%, closing at their lowest level since May 6 this year. This marks the second consecutive day of decline for Alphabet after the company reported disappointing 2Q24 earnings. This led to heavy selling of technology stocks on Wednesday (July 24), causing the Nasdaq and S&P 500 indices to experience their steepest declines since 2022.

SK Hynix, South Korean Chipmaker, Posts Highest Profit in Six Years

SK Hynix, one of the world’s leading memory chip manufacturers, reported 2Q24 revenue of 16.42 trillion won, a 125% YoY increase (approximately $11.86 billion), surpassing LSEG analysts’ forecast of 16.40 trillion won. Operating profit reached 5.47 trillion won, exceeding the forecast of 5.40 trillion won and marking the highest level since 2Q18, recovering from a loss of 2.88 trillion won in 2Q18.

Currently, SK Hynix supplies high-bandwidth memory chips to several companies, including NVIDIA.

However, SK Hynix shares fell 7.81% this morning (July 26), following the KOSPI index in South Korea, which declined by 1.91% after the U.S. stock market plunged last night (July 25) due to disappointing earnings from Alphabet and Tesla.