Weekly News Recap 2 – 6 September 2024

News for 2 September 2024

Gold Pressures the Market

At the end of last week, gold prices weakened to $2,503/oz, driven by a rebound in the dollar index, which closed at 101.73, up from 101.37. The stronger dollar pressured gold prices.

On September 2nd, gold prices further weakened, breaking below the key support level of $2,500/oz, but it is still viewed as maintaining stability.

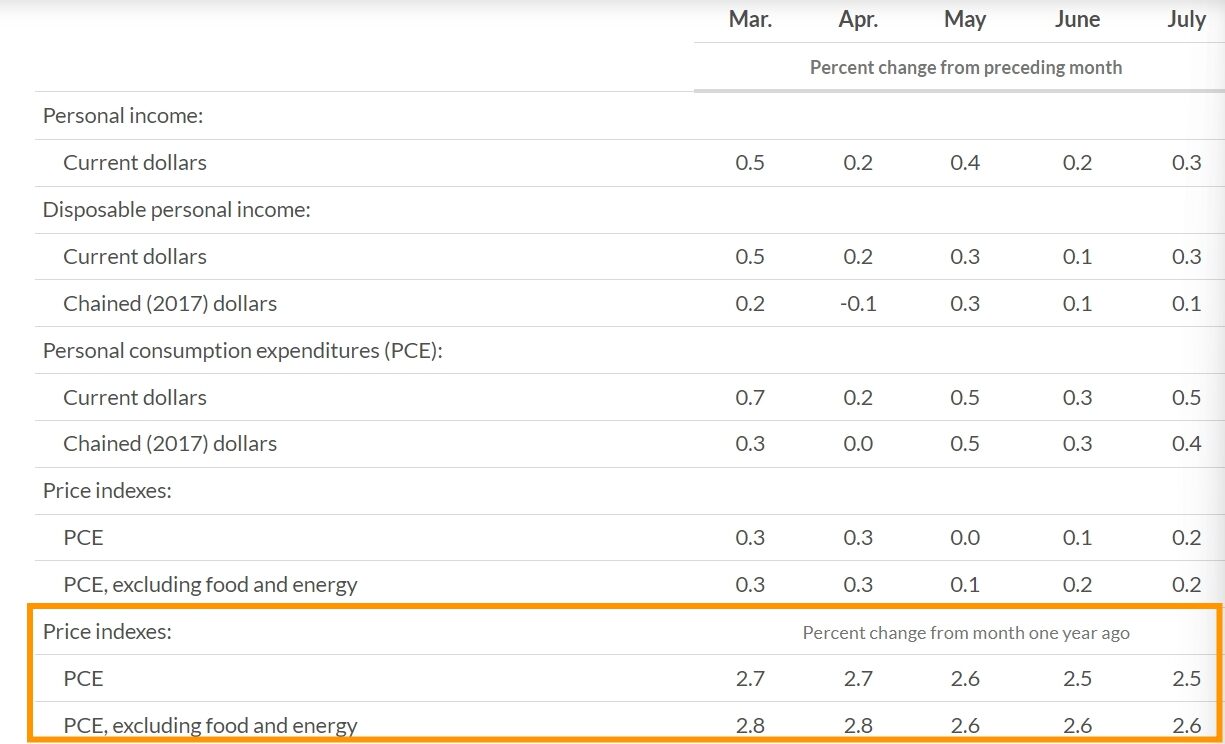

US Inflation for July Below Expectations, Both Headline and Core PCE

The US Department of Commerce reported that the Personal Consumption Expenditures (PCE) Price Index, including food and energy (Headline PCE), rose 2.5% year-over-year in July, below analysts’ expectations of 2.6%.

The Core PCE Price Index, excluding food and energy and a key inflation measure for the Federal Reserve, increased 2.6% year-over-year in July, also below the expected 2.7%. This was unchanged from June and shows a monthly comparison.

Policy Rates Enter Downtrend, Pressuring Bank NIMs – Buffett Sells BofA Shares

Warren Buffett’s Berkshire Hathaway has sold shares in Bank of America (BofA), the second-largest US bank, totaling over $6 billion in seven transactions since July this year.

Berkshire, a major shareholder in BofA, revealed that it sold approximately 21.1 million BofA shares, valued at around $845 million, between August 28-30.

Buffett began investing in BofA in 2011 when Berkshire purchased $5 billion worth of preferred shares, reflecting his confidence in CEO Brian Moynihan’s ability to revive the bank post-2008 financial crisis.

News for 3 September 2024

Gold Pressured by Rebounding Dollar Index

On September 2, gold trading volume was low due to the US Labor Day holiday. The dollar index rose, closing at 101.64, which put pressure on gold prices, causing them to drop to $2,499/oz.

On September 3 at 7:30 PM, the US Manufacturing PMI index will be announced, with a forecast of 47.5.

OPEC Reduces Oil Production Due to Libyan Conflict

Reuters’ survey reveals that OPEC’s oil production decreased by 340,000 barrels per day in August compared to July, reaching 26.36 million barrels per day, the lowest level since January. The reduction in August was influenced by production cuts in Libya amid political conflict and voluntary cuts by OPEC and its allies, known as OPEC+.

News for 4 September 2024

Gold Pressured Further as US10Y Rises

On September 3, gold prices fell to $2,493/oz due to a rise in the dollar index from 101.66 to 101.77, which pressured gold prices.

On September 4 at 9:00 PM, the US job openings number will be announced, with a forecast of 8.09 million.

In the short term, gold is under pressure from the strengthening dollar index as investors reduce exposure to risk assets and increase holdings in dollars.

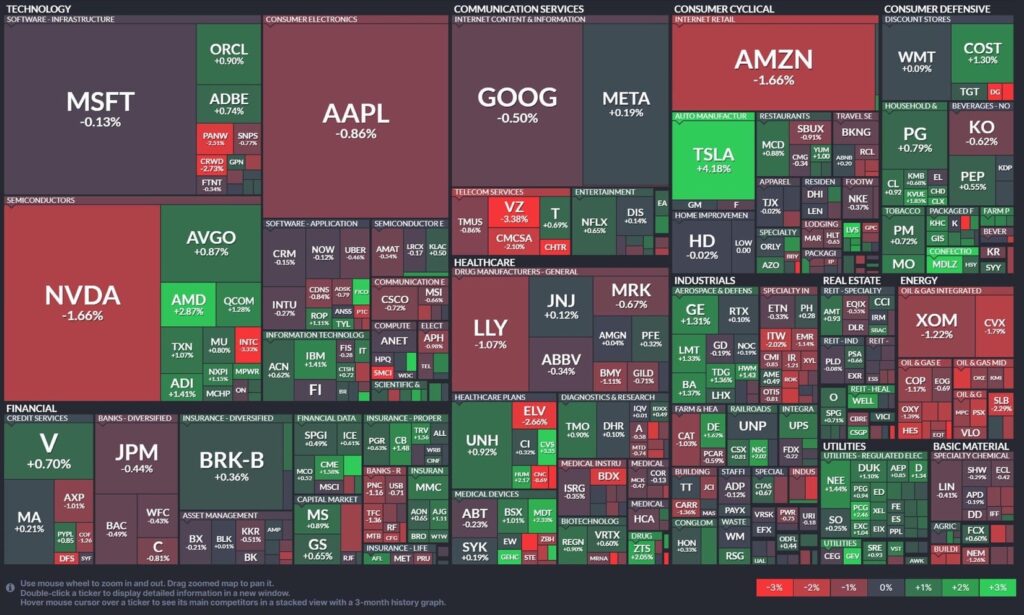

Boeing Stock (BA) Falls 7.3%

Boeing shares dropped 7.3% following Wells Fargo analysts’ downgrade of the stock to “Underweight” from “Equal-weight”.

(Preview) Broadcom 3Q24 – EPS Expected to Continue Rising

On September 5, Broadcom (AVGO) will report its 3Q24 earnings. Revenue is anticipated to rise to $12.97 billion, up 46% YoY and 4% QoQ, with EPS expected to increase to $1.21, up 15% YoY and 10% QoQ. This growth is attributed to Semiconductor solutions and Infrastructure software, which may rise to $7.43 billion (+7% YoY) and $5.54 billion (+186% YoY), respectively.

Gross margin is expected to slightly increase from 56.0% in 2Q24 to 56.5%, aligning with a projected net profit increase of 18.0% from 16.9%.

For the full year 2024, the company has raised its revenue forecast to $51 billion from $50 billion and adjusted its EBITDA guidance to approximately 61% of revenue from 60%.

News for 5 September 2024

Gold Rises as US Labor Market Contracts Sharply, Fed Rate Cut of 0.75%

On September 4, US job openings fell to 7.67 million, the lowest in two years, below the forecast of 8.09 million. This has led the market to speculate that the Fed may cut rates by 0.75% this year. The more dovish monetary policy outlook weakened the dollar index to 101.26, supporting higher gold prices.

On September 5, at 7:15 PM, the US private sector employment number will be released, with a forecast of 144k. Later at 9:00 PM, the US Services PMI will be announced, with a forecast of 51.3.

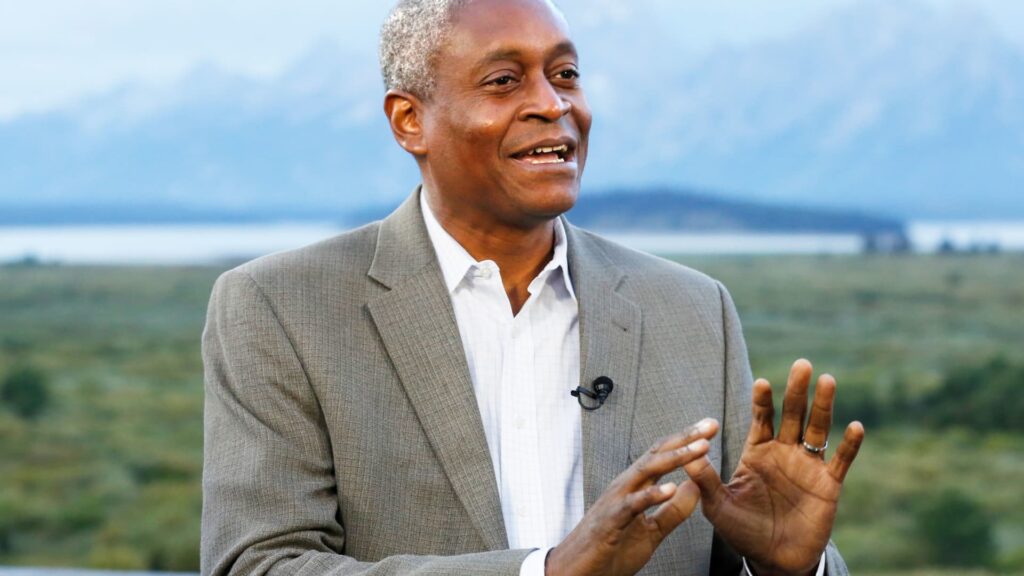

Atlanta Fed Supports Rate Hike, Cautions on Long-Term Labor Market Risks

Rafael Bostic, President of the Atlanta Fed, has stated that the Fed should not keep interest rates high for too long due to the risk of causing significant harm to employment. He also mentioned that waiting for inflation to reach the Fed’s 2% target before reducing interest rates could risk stagnating the labor market, potentially leading to unnecessary problems.

Utilities Stocks Surge on Fed Rate Cut Expectations

Eric Behrich, Chief Investment Officer at Sound Income Strategies, stated that utility stocks have surged following recent US labor data, which supports expectations that the Fed will cut interest rates by at least 0.25% in this month’s meeting.

News for 6 September 2024

Gold Rebounds as US Labor Market Weakens

On September 5, gold prices rose to $2,516/oz following the announcement of US private sector employment data, which contracted to the lowest level in 10 months at 99k. Additionally, the dollar index’s failure to break through resistance led to its decline, supporting gold’s rise.

On September 6, attention will be on the US August labor market report, with forecasts of 164k non-farm jobs and a 4.2% unemployment rate.

The labor market’s continued contraction could lead the market to expect the Fed to cut rates three times or 0.75% this year, with a weaker dollar supporting higher gold prices.

Tesla Stock Jumps Nearly 5% on Full Self-Driving Software Announcement

Tesla shares surged nearly 5% after the company announced plans to launch its Full Self-Driving software in Europe and China in the first quarter of next year, pending regulatory approval.

WTI Oil Prices Drop 0.07%

WTI crude oil futures fell by 5 cents, or 0.07%, closing at $69.15 per barrel, the lowest closing level since December 2023. The decline reflects ongoing investor concerns about slowing oil demand in the US and China, as well as the potential for increased oil production from Libya.

Broadcom Beats Revenue and Earnings Expectations

On September 5, Broadcom (AVGO) reported its 3Q24 results, with revenue rising to $13.072 billion, up 47% YoY and 5% QoQ, and EPS increasing to $1.24, up 18% YoY and 13% QoQ. This growth was driven by Semiconductor solutions revenue rising to $7.274 billion (+5% YoY), accounting for 56% of total revenue, and Infrastructure software revenue increasing to $5.798 billion (+200% YoY), making up 44% of total revenue.

For 3Q24, the gross margin decreased to 64% from 69% in 3Q23, and the net margin fell to 47% from 52%. The decline was attributed to higher costs associated with Infrastructure software compared to Semiconductor solutions, affecting both gross and net margins.

4Q24 Guidance

Revenue is expected to rise to $14 billion, up 51% YoY and 7% QoQ, but below analysts’ estimate of $14.13 billion. Adjusted EBITDA is projected at 64%, up from 63% in 3Q24.

Broadcom also announced a dividend payment of $0.53 per share, with the ex-dividend date on September 19, 2024, representing a yield of 0.34%.