Weekly News Recap 28 October – 1 November 2024

News for 28 October 2024

Gold Weakens This Morning Following Limited Impact from Israeli Attacks

Last week, gold prices rose to $2,747/oz at the market’s close due to buying pressure as a safe-haven asset after Israel attacked an Iranian weapons manufacturing facility, prompting investors to flock to gold for risk protection.

However, on the morning of October 28, gold prices weakened to $2,727/oz as the impact of the incident remained limited, leading to increased market relaxation and a flow of money back into riskier assets. It is anticipated that gold prices will move within a range of $2,715 to $2,735 per ounce during the day, with the possibility of a sideways adjustment.

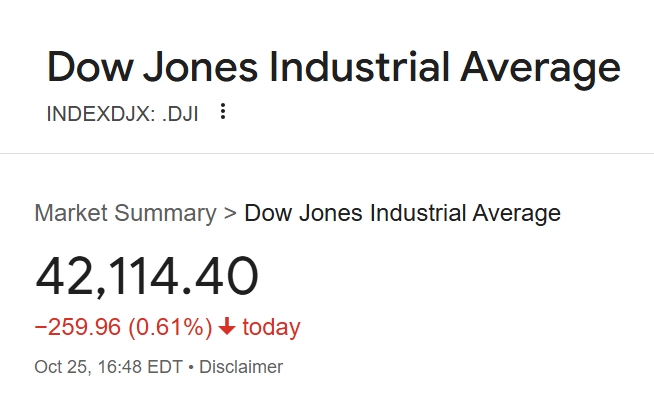

Dow Jones Drops Due to Pressure from Banking Stocks and Health Crisis at McDonald’s

The Dow Jones Index fell as selling pressure in banking stocks emerged as a key factor, particularly with Goldman Sachs shares dropping 2.27%. Additionally, McDonald’s shares declined 2.97% as the company faced an E. coli outbreak linked to its hamburger products, leading to a less optimistic investment atmosphere.

China’s Industrial Profits Plummet 27% in September, Reflecting Weak Demand and Economic Slowdown

China’s National Bureau of Statistics (NBS) reported that industrial profits dropped by 27.1% in September, marking the steepest decline this year after an August decrease of 17.8%. This sharp drop indicates that the Chinese economy remains weak, highlighting the necessity for the government to implement additional economic stimulus measures.

Analyst Wei Ning predicts that the recently announced economic stimulus measures by the Chinese government will help support the production and operational environment of the industrial sector, potentially aiding in the recovery of industrial profits in the future.

According to a Reuters report, these industrial profit figures are derived from a survey of companies with core business revenues of at least 20 million yuan (approximately $2.75 million). Industrial profits are a key indicator of the financial status of the manufacturing, mining, and public utilities sectors nationwide, which could influence companies’ investment decisions in the coming months.

News for 29 October 2024

Gold Prices Drop as Investors Sell Tech Stocks, Await U.S. Earnings Reports

Gold prices fell to close at $2,742 per ounce as some investors reduced their positions in U.S. technology stocks in anticipation of mid-week earnings reports. This shift contributed to a strengthening dollar index, which put further pressure on gold prices in the market.

On October 29 at 21:00, the U.S. is set to announce consumer confidence index and job openings figures, with forecasts of 99.5 and 7.98 million positions, respectively. These announcements could have implications for the short-term outlook of gold.

Boeing Shares Drop 2.8% as Company Plans Stock Offering to Address Financial Crisis

Boeing’s stock fell 2.8% following reports that the company is preparing to issue new shares to raise up to $22 billion. This move aims to bolster liquidity and support the company’s financial position, which is crucial as it faces impacts from ongoing employee protests.

Preview of Google 3Q24 Earnings: Expected Revenue Increase but Decrease in EPS QoQ

For Q3 2024, Google’s (GOOG) revenue is projected to rise to $86.29 billion, representing a 12% increase year-over-year (YoY) and a 2% increase quarter-over-quarter (QoQ). However, earnings per share (EPS) may decrease to $1.83, which is up 18% YoY but down 3% QoQ. This decline is attributed to slow growth in advertising revenue, which is expected to increase by only 1% QoQ to $65 billion.

On the other hand, revenue from Google Cloud is anticipated to grow to $11 billion, reflecting a 6% QoQ increase, which could boost the gross margin to 58%, up from 57% in the same quarter last year (3Q23). Additionally, the net profit margin may improve to 28% from 26% in 3Q23.

With a P/E ratio of approximately 24, close to the average of the past four quarters, the stock price appears attractive.

News for 30 October 2024

Gold Continues to Rise

On October 29, the price of gold increased, closing at $2,774 per ounce. This rise was driven by uncertainty surrounding the upcoming U.S. presidential election and heightened tensions in the Middle East, leading to increased demand for gold as a safe-haven asset.

On October 30, at 7:15 PM, the U.S. will release private sector employment figures, with expectations set at 110,000 jobs, followed by the Advance GDP report at 7:30 PM, projected at 3.0%.

It is anticipated that gold prices will continue to respond positively to the ongoing uncertainty in the Middle East and potential contraction in the U.S. labor market.

US10Y Yield Surpasses 4.3%, Impacting Markets and Financial Costs

The yield on the 10-year U.S. government bond surged past 4.3%, significantly affecting the financial markets. As a key benchmark for pricing global debt instruments, including U.S. mortgage rates, this increase in yield raises borrowing costs for consumers, particularly for mortgage payments. Companies are also facing higher debt servicing costs, which could lead to a trend of reduced investment and potential cuts in dividend payouts to shareholders.

Pfizer Reports Higher-Than-Expected 3Q24 Earnings and Revenue Driven by Paxlovid Sales

Pfizer announced its Q3 2024 earnings, reporting profits and revenue that surpassed analysts’ expectations, bolstered by strong sales of Paxlovid, the COVID-19 treatment. However, despite the positive results, Pfizer’s stock closed down 1.4%, reflecting investor concerns about future growth prospects.

PayPal Shares Drop 3.9% After Q3 Revenue Misses Expectations

PayPal, the online payment service provider, saw its shares decline by 3.9% following the announcement of its Q3 2024 revenue, which came in at $7.85 billion, falling short of analysts’ expectations of $7.89 billion. This shortfall has raised investor concerns regarding the company’s performance and future growth prospects.

News for 31 October 2024

Gold Continues to Rise

On October 30, gold prices increased, closing at $2,787 per ounce, buoyed by the announcement that U.S. GDP grew only 2.8%, below analysts’ expectations of 3.0%. This prompted increased buying of gold as a safe-haven asset.

On October 31, at 7:30 PM, the U.S. will release the Core PCE (Personal Consumption Expenditures) inflation index, with expectations set at 0.3%, alongside weekly jobless claims projected at 229,000. Gold prices are expected to continue responding positively to this news.

Super Micro Computer Shares Plunge 32.6%

Super Micro Computer’s stock fell dramatically by 32.6% following reports that Ernst & Young has withdrawn as the company’s auditor. This raised investor concerns regarding the transparency and reliability of the financial statements of the chip manufacturer. The news has heightened market anxiety about Super Micro Computer’s financial status and future operations.

News for 1 November 2024

Gold Prices Decline as Investors Reduce Positions Ahead of Election

On October 31, gold prices softened, closing at $2,743 per ounce, as investors took profits after prices previously surged to an all-time high. This sell-off was driven by a desire to manage risk ahead of the upcoming U.S. elections.

On November 1, at 19:30 GMT, the U.S. labor market data will be released, including employment figures and the unemployment rate, which are expected to be 106,000 and 4.1%, respectively.

Despite these fluctuations, gold prices remain stable, even amid the possibility of Iran launching attacks on Israel before the U.S. elections, which could support a rise in gold prices.

VIX Index Surges Over 13% Amid Concerns About Earnings and U.S. Elections

The VIX index, which measures stock market volatility, jumped more than 13% as investors expressed concerns about corporate earnings and the uncertainty surrounding the upcoming U.S. presidential election scheduled for November 5. Additionally, the Federal Reserve’s monetary policy meeting set for November 6-7 is adding to market unease. These two events are creating uncertainty in the market, leading investors to worry about the future direction of the economy and the stock market.

Polls Show Tight Race Between Kamala Harris and Donald Trump Ahead of November 5 Election

Recent polls indicate that Kamala Harris, the Democratic candidate, and Donald Trump, the Republican candidate, are in a tight race as the presidential election approaches on November 5. Investor concerns have risen regarding Trump’s proposed measures, such as tax cuts and regulatory rollbacks in the financial sector, which could lead to increased budget deficits and higher inflation in the U.S. These factors may influence the Federal Reserve to slow down interest rate cuts in the future, adding to the uncertainty surrounding the election outcomes and their potential economic implications.