Weekly News Recap 7 – 11 October 2024

News for 7 October 2024

Gold Edges Lower

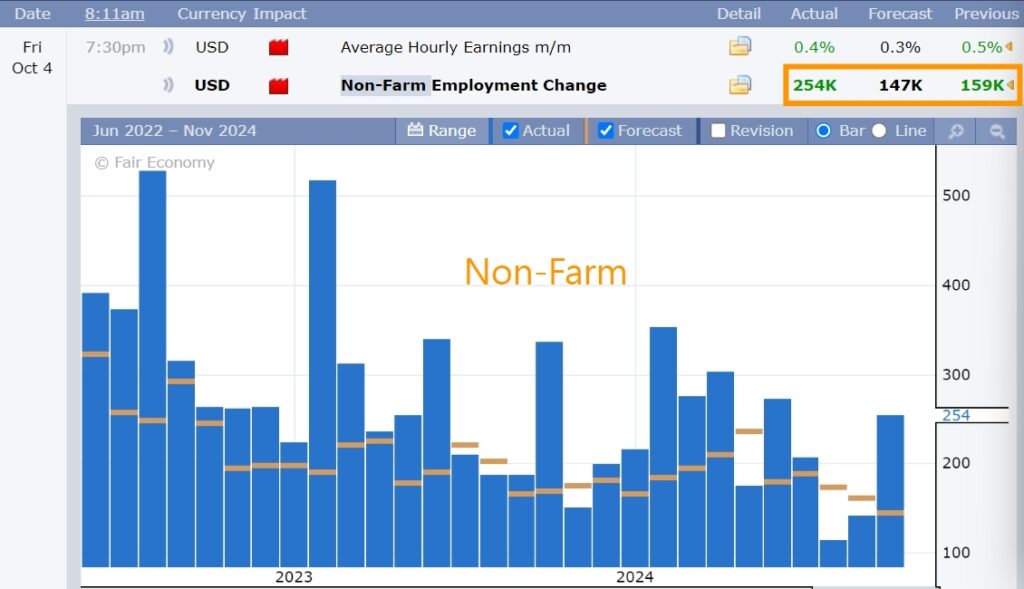

Sa pagtatapos ng nakaraang linggo, bumaba ang presyo ng ginto, na nagtapos sa $2,653 kada onsa. Ito ay dulot ng mas malakas kaysa inaasahang datos ng non-farm payrolls at unemployment ng U.S., na umabot sa 254,000 trabaho at 4.1%, ayon sa pagkakabanggit. Bukod dito, ang U.S. Dollar Index ay tumaas sa 102.48, na nagdagdag ng presyon sa presyo ng ginto.

Inaasahan na ang ekonomiya ng U.S. ay maaaring makaranas ng "soft landing," na posibleng magdala ng mas maraming pondo sa mas mapanganib na mga asset. Gayunpaman, patuloy na maaapektuhan ang presyo ng ginto ng mga geopolitical tensions sa Gitnang Silangan at ang posibleng epekto nito sa hinaharap.

U.S. Job Growth Soars in September, Reaches 6-Month High

Tumaas ang trabaho sa U.S. noong Setyembre, ayon sa ulat ng Department of Labor noong Biyernes na ang non-farm payrolls ay tumaas ng 254,000 trabaho. Ito ang pinakamataas na pagtaas sa loob ng anim na buwan at higit pa sa inaasahan ng mga analyst na 147,000 trabaho. Ito ay matapos ang pagtaas ng 159,000 trabaho noong Agosto.

WTI Oil Rises 0.9% on Middle East Conflict Concerns

Ang WTI crude oil para sa Nobyembre na paghahatid ay tumaas ng 67 sentimo, o 0.9%, upang magsara sa $74.38 kada bariles. Ang lingguhang pagtaas na ito ay ang pinakamalaki sa loob ng higit isang taon, dulot ng mga alalahanin sa epekto ng patuloy na kaguluhan sa Gitnang Silangan. Gayunpaman, napigil ang pagtaas ng presyo matapos ang babala ni Pangulong Joe Biden sa Israel na iwasang targetin ang mga pasilidad ng langis ng Iran.

Gold Prices Could Reach 45,000 THB Amid Middle East Conflict

Ayon kay Anusorn Tamajai, Dekano ng Faculty of Economics sa University of Thai Chamber of Commerce, posibleng makaranas ng matinding volatility ang presyo ng ginto, na maaaring tumaas at bumaba ng maraming beses sa loob ng isang araw. Gayunpaman, kung patuloy na lumala ang kaguluhan sa Gitnang Silangan, maaaring umabot ang global na presyo ng ginto sa $2,700 kada onsa sa malapit na hinaharap at maaaring tumaas sa 45,000 THB kada baht ng ginto sa pangmatagalan kung lumawak ang labanan.

Dagdag pa rito, ang mga pamumuhunan sa mga risk asset ay nananatiling hindi tiyak at sobrang volatile dahil sa malalakas na datos ng trabaho sa U.S., na maaaring magpaliban ng mga interest rate cut. Ang mas malakas na dolyar ay naglalagay din ng presyon sa presyo ng ginto. Gayunpaman, kung ang Federal Reserve ay magbabawas lamang ng interest rate ng 0.25% sa kanilang pagpupulong sa Nobyembre, ang Dollar Index ay maaaring bahagyang tumaas, na magbibigay ng maikling panahong presyon sa ginto. Sa pangmatagalan, inaasahang humina ang dolyar, na magbibigay ng pagkakataon sa ginto na patuloy na tumaas.

News for 8 October 2024

Gold Softens as U.S. Bond Yields Rise

Noong Oktubre 7, bumaba ang presyo ng ginto, nagtapos sa $2,642 kada onsa. Ang pagbaba na ito ay dulot ng pagtaas ng U.S. 10-year Treasury yields na umabot sa 4.0%, na nagtulak sa mga mamumuhunan na ibenta ang ginto na walang interes o yield.

Inaasahan na ang presyo ng ginto ay papasok sa sideways-down na galaw.

Hurricane Impacts U.S. Economy: Growth Slows, Costs Rise

Matapos tamaan ng Hurricane Helene ang anim na estado sa U.S., na nagdulot ng mahigit 200 pagkamatay, nakaranas ang ekonomiya ng U.S. ng malaking pinsala. Ang mga pangunahing sektor, kabilang ang imprastruktura, pagmamanupaktura, at transportasyon, ay naapektuhan, na nagdulot ng pagbagal ng paglago ng ekonomiya. Inaasahang aabutin ng panahon ang pagbangon at magreresulta ito sa mas mataas na gastusin sa pananalapi at insurance. Bukod dito, maaaring tumaas ang presyo ng ilang mga produkto dahil sa mas mataas na demand. Inaasahan ding tatama ang Hurricane Milton sa U.S. sa pagtatapos ng linggo.

Goldman Sachs Lowers U.S. Recession Forecast Following Strong Employment Data

Sinabi ni Jan Hatzius, Chief Economist ng Goldman Sachs, na ang ulat ng trabaho noong Setyembre ay "nagbago ng pananaw para sa labor market," na nagpapaluwag ng mga alalahanin sa isang posibleng napaagang pagbagal ng demand sa trabaho na maaaring magdulot ng hindi maiwasang pagtaas sa mga unemployment rate. Ipinapakita rin niya ang patuloy na pagbawas ng interest rate ng 0.25% hanggang umabot sa range na 3.25-3.5% sa Hunyo sa susunod na taon.

Dahil dito, binawasan ng Goldman Sachs ang pagtataya nito para sa posibilidad ng recession sa U.S. sa loob ng susunod na 12 buwan ng 5%, na bumaba sa 15%.

Halifax Reports UK House Prices Surge in September 2023, Highest Since November 2022

Ayon sa Reuters, ipinakita ng datos ng Halifax na ang presyo ng mga bahay sa U.K. ay tumaas ng 4.7% taon-taon noong Setyembre, bahagyang tumaas mula sa 4.3% noong Agosto ngunit mas mababa kaysa sa inaasahan ng mga analyst na 5.2% na pagtaas.

Marami sa mga ekonomista sa survey ay inaasahan na ibababa ng Bank of England (BoE) ang mga interest rate sa susunod nitong pagpupulong sa Nobyembre, matapos panatilihin ang mga rate sa 5% sa kanilang nakaraang pagpupulong.

Marami sa mga ekonomista sa survey ay inaasahan na ibababa ng Bank of England (BoE) ang mga interest rate sa susunod nitong pagpupulong sa Nobyembre, matapos panatilihin ang mga rate sa 5% sa kanilang nakaraang pagpupulong.

News for 9 October 2024

Gold Weakens Amid Ceasefire Hopes

Bumagsak nang malaki ang presyo ng ginto, nagtapos sa $2,621 kada onsa dahil sa inaasahan na maaaring magkaroon ng ceasefire agreement sa pagitan ng Hezbollah at Israel. Dahil dito, maraming mamumuhunan ang nagbenta ng ginto, na karaniwang itinuturing na isang ligtas na pamumuhunan.

Bukod dito, ang resulta ng pagpupulong ng U.S. FOMC na ilalabas ng 1:00 AM sa Oktubre 9 ay maaaring makaapekto sa galaw ng ginto, na may mga indikasyon na ang mahalagang metal ay nagsisimula nang mawalan ng katatagan.

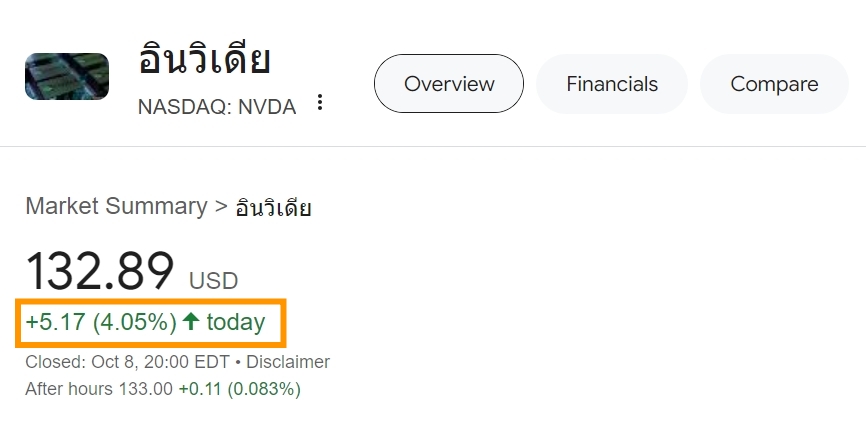

“Magnificent Seven” Stocks Surge Led by NVIDIA

Malakas ang pagtaas ng “Magnificent Seven” stocks, kung saan ang NVIDIA ang nangunguna na may 4.1% na pagtaas, na siyang pinakamalakas na pagtaas sa loob ng isang araw sa loob ng isang buwan. Tumaas din ang Microsoft ng 1.2%, ang Apple ng 1.8%, ang Alphabet ng 0.8%, ang Amazon ng 1.06%, ang Tesla ng 1.5%, at ang Meta Platforms ng 1.4%.

News for 10 October 2024

Gold Drops Sharply as the Dollar Index Rises

Noong Oktubre 9, bumagsak ang presyo ng ginto sa $2,607 kada onsa, dulot ng matalim na pagtaas ng Dollar Index, na tumaas mula 102.42 hanggang 102.87, na naglagay ng presyon sa ginto.

Sa Oktubre 10 ng 7:30 PM, iaanunsyo ang U.S. Consumer Price Index (CPI) para sa Setyembre, na inaasahang nasa 2.3%.

Inaasahang ang presyo ng ginto ay magpapatuloy sa sideways movement na may pababang bias.

Alphabet Drops 1.5%

Ang shares ng Alphabet ay bumaba ng 1.5% matapos ang ulat na ang U.S. Department of Justice ay maaaring maghain ng petisyon sa korte upang pilitin ang kompanya, ang magulang ng Google, na ibenta ang ilan sa kanilang mga negosyo. Kasama rito ang Chrome browser at Android operating system, dahil naniniwala ang DOJ na ginagamit ng Google ang mga ito upang ma-monopolize ang merkado ng online search.

News for 11 October 2024

Gold Rebounds, Faces Key Resistance

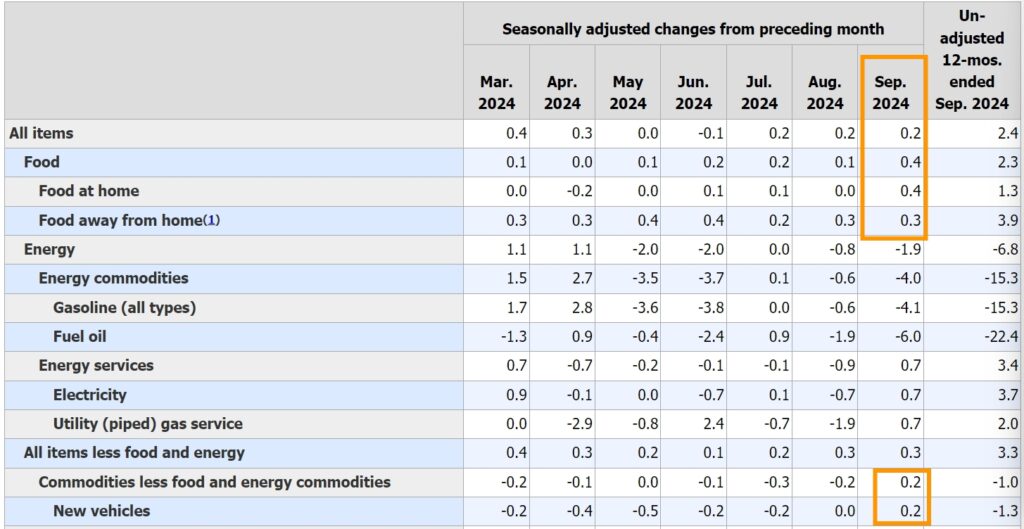

Noong Oktubre 10, muling tumaas ang presyo ng ginto sa $2,630 kada onsa kasunod ng ulat ng inflation sa U.S. para sa Setyembre na mas mataas kaysa inaasahan sa 2.4%, bagaman bahagyang mas mababa sa nakaraang 2.5%.

Noong Oktubre 2 ng 7:30 PM, inanunsyo ang U.S. Producer Price Index (PPI) na may inaasahang 0.1%. Gayunpaman, inaasahang limitado ang pagtaas ng presyo ng ginto habang papalapit ito sa mga pangunahing resistance levels.

U.S. Inflation Holds Steady in 2.4%-2.5% Range, Driven by Services and Oil Prices

Nanatiling mataas ang inflation sa U.S., lalo na mula sa sektor ng serbisyo, partikular sa pagkain at transportasyon. Inaasahan na ang inflation para sa Oktubre ay mananatili sa 2.4%-2.5% range, bahagyang dulot ng naantalang epekto ng presyo ng langis sa mga produktong serbisyo. Ang epekto ng pagbabago ng presyo ng langis sa inflation ay karaniwang mabagal na makikita, na maaaring magpanatili sa inflation sa mga antas na tulad ng mga nakaraang buwan.

- Pagkain at Transportasyon: Ang mga kategoryang ito sa sektor ng serbisyo ang nagbibigay ng pinakamalaking kontribusyon sa inflation dahil sa tumataas na gastos sa produksyon at transportasyon na may kaugnayan sa mataas na presyo ng langis.

- Pananaw sa Inflation: Sa kabila ng patuloy na mataas na gastos sa langis at transportasyon, inaasahan na mananatiling matatag ang inflation rate sa 2.4%-2.5% range sa Oktubre, nang walang malaking short-term pressure mula sa sektor ng serbisyo.

- Epekto sa Patakaran ng Fed: Ang matatag na inflation rate ay maaaring mag-alis ng mga alalahanin tungkol sa mabilis na pagtaas ng interest rate ng Federal Reserve. Ang mga market participant ay malamang na tututok sa mga susunod na desisyon sa interest rate, na binabantayan ang tugon ng Fed sa kasalukuyang inflationary environment.

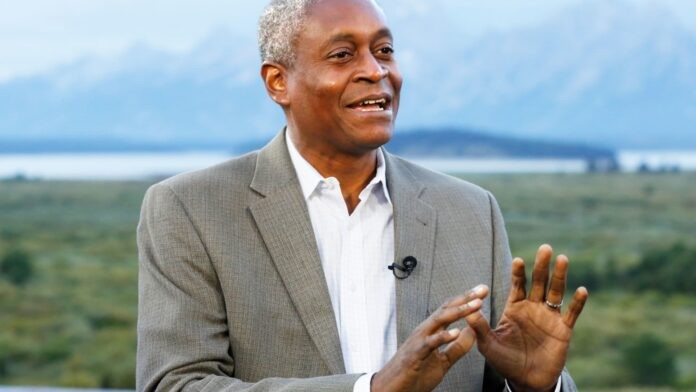

Bostic Supports Fed Keeping Interest Rates Unchanged in November Meeting

Si Raphael Bostic, Pangulo ng Atlanta Federal Reserve, ay kamakailan lamang nagpahayag ng kanyang suporta para sa pagpapanatili ng interest rates ng Federal Reserve sa darating na pagpupulong sa Nobyembre. Ito ay matapos ang kamakailang inilabas na inflation at employment data na nagpapakita ng volatility, na sumasalamin sa patuloy na kawalan ng katiyakan sa ekonomiya. Binanggit ni Bostic na habang ang mga naunang rate hike ay nakatulong sa pagpapagaan ng ilang inflationary pressures, ang kasalukuyang volatility sa data ay hindi sapat upang bigyang-katwiran ang isa pang pagtaas ng interest rate sa ngayon.

agdag pa niya, kailangan pa ng Fed na subaybayan ang karagdagang economic data upang masuri nang epektibo ang pangmatagalang inflation trends at paglago ng ekonomiya. Binibigyang-diin niya na ang mga susunod na desisyon ay kailangang mag-ingat na balansehin ang pagkontrol sa inflation at pagsuporta sa paglago ng ekonomiya.