13 na Pinakapopular na Trading Chart Patterns

A pattern means a repeated element in different spheres of life – nature, psychology, music, design, trading, etc. When it comes to trading, a trading chart pattern is a stable and repeated combination of data on prices, volumes, or indicators.

Chart patterns in trading

Trading in financial markets is a popular way to invest and grow one’s wealth. However, trading can be a complicated process that requires a deep understanding of various factors that affect the market. One important aspect of trading is the ability to analyze charts and identify patterns that indicate the direction of the market. In this article, we will discuss chart patterns in trading and how they can be used to make informed trading decisions.

Chart patterns are visual representations of historical price movements in financial markets. These patterns can help traders identify trends, reversals, and other trading opportunities. Chart patterns are created by plotting price movements over time, typically using candlestick charts or line charts.

What is a chart pattern in tech analysis?

Trading chart patterns are specific and repeated areas on the price charts and sometimes they are called price patterns or formations.

Over the years of monitoring financial markets, it was noticed that from time to time the price charts showed trading patterns (or price patterns), which might be used to predict further movements. There are patterns that indicate the reverse of tendencies and there are formations that show their continuation. Here, it would be important to note that formation of price patterns on charts does not 100% mean that the price will move as these patterns predict, but there is a possibility of matching and may help in trading. There are several common chart patterns that traders use to identify potential trading opportunities.

Head & Shoulders and Inverted Head & Shoulders trading chart patterns

These are reversal patterns, which are usually formed at local lows and highs of the price chart within either ascending or descending trend. The patterns indicate that the current tendency is getting weaker and the price is expected to either start a correction or reverse the tendency to the opposite side.

Head & Shoulders

Head & Shoulders chart pattern is formed at highs within an ascending tendency. A bottom line is drawn through 1 and 2 (neckline). The trading pattern is considered completely formed only after the price fixes below the bottom line. After that, the price is expected to fall by the distance equal to, at least, the pattern height, which is measured in pips from the pattern’s high to the neckline. One is recommended to sell right when the price breaks the bottom line or wait until it returns to the line after breaking it.

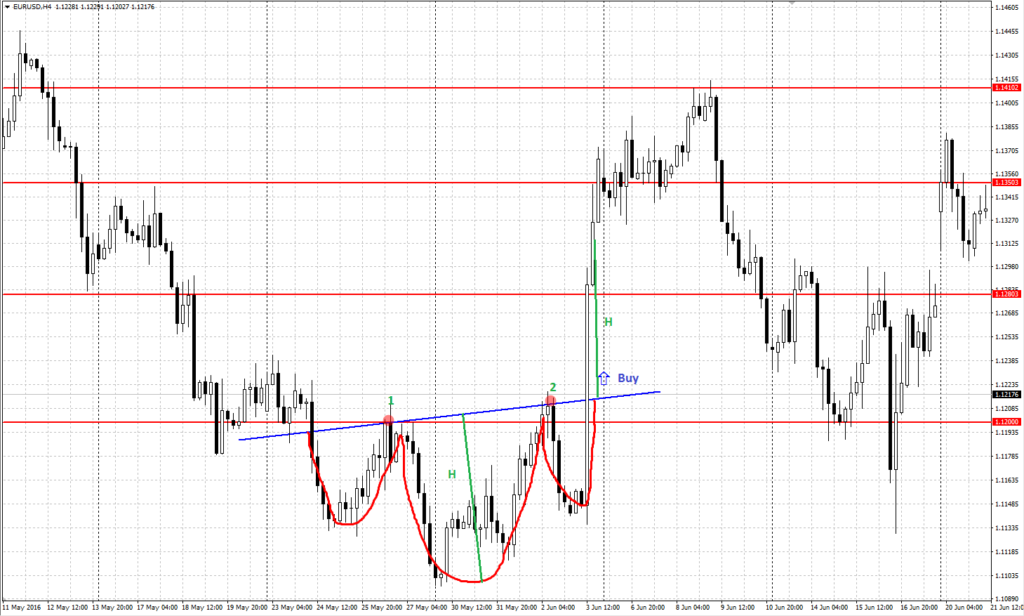

Inverted Head & Shoulders

Inverted Head & Shoulders chart pattern is formed at lows within a descending tendency. A bottom line is drawn through 1 and 2 (neckline). The trading pattern is considered completely formed only after the price fixes above the bottom line. After that, the price is expected to grow by the distance equal to, at least, the formation height, which is measured in pips from the pattern’s low to the neckline. One is recommended to buy right when the price breaks the bottom line or wait until it returns to the line after breaking it.

Double Top and Double Bottom chart patterns

These are reversal trading patterns, which are usually formed at local lows and highs of the price chart within either ascending or descending trend. The patterns indicate that the current tendency is getting weaker and the price is expected to either start a correction or reverse the tendency to the opposite side.

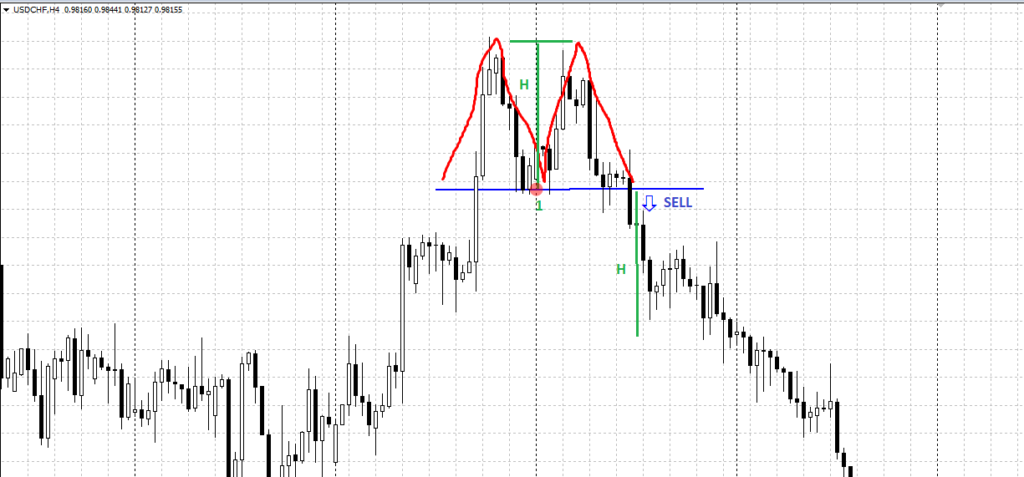

Double Top

Double Top chart pattern is formed at highs within an ascending tendency. A horizontal bottom line is drawn through 1. The trading pattern is considered completely formed only after the price fixes below the bottom line. After that, the price is expected to fall by the distance equal to, at least, the pattern height, which is measured in pips from the pattern’s highs to the bottom line. One is recommended to sell right when the price breaks the bottom line or wait until it returns to the line after breaking it.

Double Bottom

Double Bottom chart pattern is formed at lows within a descending tendency. A horizontal bottom line is drawn through 1. The trading pattern is considered completely formed only after the price fixes above the bottom line. After that, the price is expected to grow by the distance equal to, at least, the figure height, which is measured in pips from the pattern’s lows to the bottom line. One is recommended to buy right when the price breaks the bottom line or wait until it returns to the line after breaking it.

Triple Top and Triple Bottom chart patterns

These are reversal chart patterns, which are usually formed at local lows and highs of the price chart within either ascending or descending trend. The patterns indicate that the current tendency is getting weaker and the price is expected to either start a correction or reverse the tendency to the opposite side.

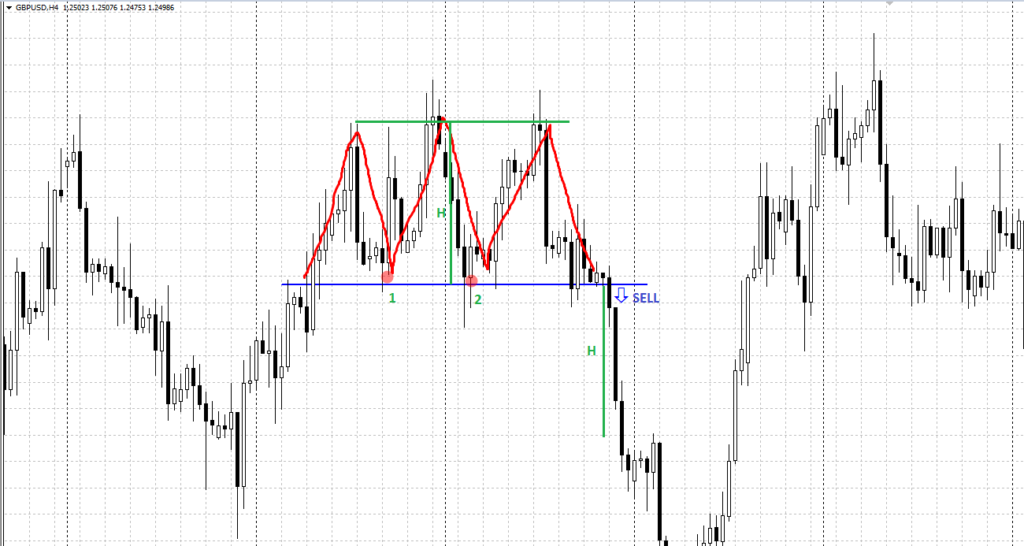

Triple Top

Triple Top chart pattern is formed at highs within an ascending tendency. A bottom line is drawn through 1 and 2. The trading pattern is considered completely formed only after the price fixes below the bottom line. After that, the price is expected to fall by the distance equal to, at least, the formation height, which is measured in pips from the pattern’s highs to the bottom line. One is recommended to sell right when the price breaks the bottom line or wait until it returns to the line after breaking it.

Triple Bottom

Triple Bottom chart pattern is formed at lows within a descending tendency. A bottom line is drawn through 1 and 2. The trading pattern is considered completely formed only after the price fixes above the bottom line. After that, the price is expected to grow by the distance equal to, at least, the formation height, which is measured in pips from the pattern’s lows to the bottom line. One is recommended to buy right when the price breaks the bottom line or wait until it returns to the line after breaking it.

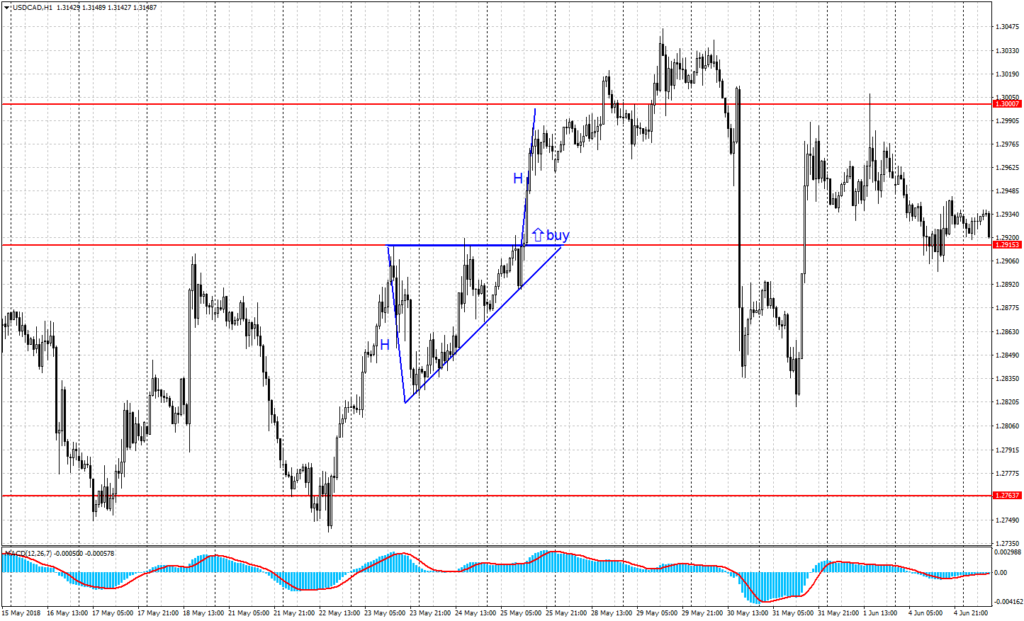

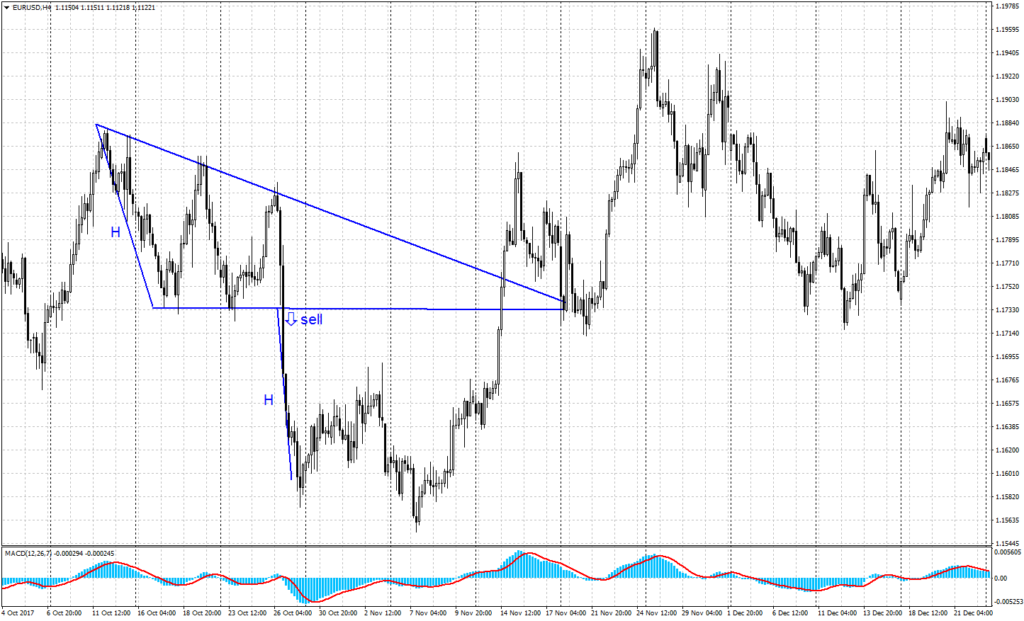

Wedge chart pattern

Wedge chart pattern is a reversal trading pattern, which is formed at highs and lows between two convergent lines, support and resistance. The chart pattern has some similar features of Triangle with the key distinction being skew angle (of both lines forming it) in the same direction. Wedge is considered broken when the price leaves the chart pattern in the direction that is opposite to the skew. If Wedge is formed at highs within an ascending tendency, one is recommended to sell after the price fixes below the support line; the target of the figure is the value of the chart pattern’s base (H) in pips. If Wedge is formed at lows within a descending tendency, one is recommended to buy after the price fixes above the resistance line; the target of the formation is the value of the chart pattern’s base (H) in pips.

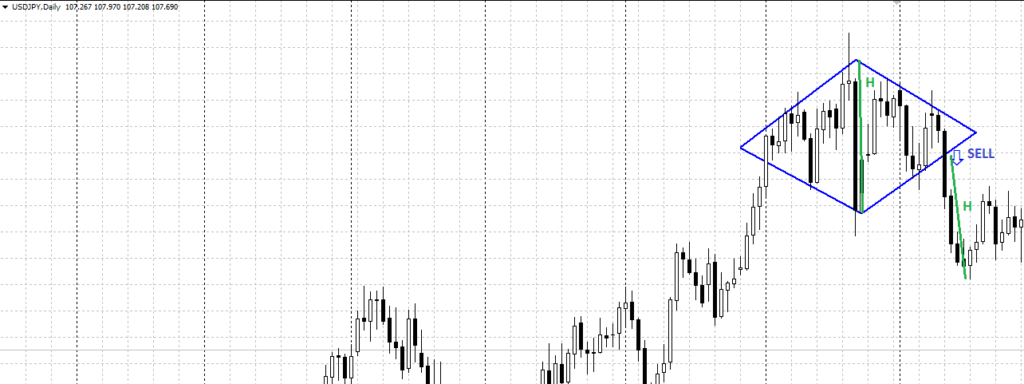

Diamond chart pattern

Diamond trading chart pattern is formed at local highs and lows of the price chart within either ascending or descending trend. The trading patterns indicate that the current tendency is getting weaker and the price is expected to either start a correction or reverse the tendency to the opposite side. If Diamond is formed at highs within an ascending tendency, one is recommended to sell after the price fixes below the support line; the target of the formation is the chart pattern’s height (H) in pips. If Diamond is formed at lows within a descending tendency, one is recommended to buy after the price fixes above the resistance line; the target of the figure is the chart pattern’s height (H) in pips.

Rectangle trading chart pattern

Rectangle trading chart pattern is a universal trading pattern that may predict both a reverse and a continuation of an actual tendency. It looks like a sideways channel formed by horizontal support and resistance level, where the price is consolidating. It is recommended to trade in the direction the formation is broken – if the price fixes above the resistance line, buy; if it fixes below the support line, sell. The target of the figure is the chart pattern’s height (H) in pips.

Flag chart pattern

A flag pattern is a continuation trading pattern of an actual tendency. It looks like a flag: after a strong price movement (Flagpole), the price is forming a correctional area (Cloth), which is either horizontal or sloping towards the Flagpole. The Cloth may take the form of Rectangle, Triangle, or Wedge. After the price completes the correction and fixes above the resistance line of the Cloth, one is recommended to buy. The target of the chart pattern is the Flagpole’s height.

Triangle trading chart patterns

There are three key types of Triangle chart patterns:

Symmetrical Triangle

Symmetrical Triangle is a universal trading pattern that may predict both a reverse and a continuation of an actual tendency. It is formed between two convergent lines, support and resistance. It is recommended to trade in the direction the figure is broken – if the price fixes above the resistance line, buy; if it fixes below the support line, sell. The target of the figure is the value of the pattern’s base (H) in pips.

Ascending Triangle

Ascending Triangle is an upside continuation trading pattern, which is formed between a horizontal resistance line and an ascending support line. After the price fixes above the resistance line, one is recommended to buy; the target of the figure is the value of the chart pattern’s base (H) in pips.

Descending Triangle

Descending Triangle is a downside continuation trading pattern, which is formed between a horizontal support line and a descending resistance line. After the price fixes below the support line, one is recommended to sell; the target of the formation is the value of the chart pattern’s base (H) in pips.

Bullish and bearish trading chart patterns

Bullish and bearish chart patterns are two types of patterns that traders use to analyze financial markets and make informed trading decisions. These patterns are based on the concept that past price movements can indicate future price movements.

Bullish chart patterns

Bullish chart patterns are patterns that indicate that the price of an asset is likely to increase. These patterns typically occur during uptrends or after a downtrend has ended. Some common bullish chart patterns include:

- Cup and Handle: A bullish continuation pattern that looks like a “U” shape, followed by a small dip and then a slightly upward-sloping handle. This pattern indicates that the price of the asset is likely to continue its uptrend.

- Ascending Triangle: A bullish continuation pattern that is characterized by a flat top and an upward-sloping bottom. This pattern indicates that the price of the asset is likely to continue its uptrend.

- Bullish Flag: A bullish continuation pattern that is characterized by a sharp price move followed by a brief period of consolidation. This pattern indicates that the price of the asset is likely to continue its uptrend.

Bearish chart patterns

Bearish chart patterns are patterns that indicate that the price of an asset is likely to decrease. These patterns typically occur during downtrends or after an uptrend has ended. Some common bearish chart patterns include:

- Double Top: A bearish reversal pattern that occurs when the price of an asset reaches a high point, drops, rises again to the same high point, and then drops again. This pattern indicates that the price of the asset is likely to reverse its uptrend and start a downtrend.

- Descending Triangle: A bearish continuation pattern that is characterized by a flat bottom and a downward-sloping top. This pattern indicates that the price of the asset is likely to continue its downtrend.

- Head and Shoulders: A bearish reversal pattern that consists of three peaks, with the middle peak (the head) being the highest. This pattern indicates that the price of the asset is likely to reverse its uptrend and start a downtrend.

Konklusyon

In conclusion, chart patterns are an important tool that traders use to identify potential trading opportunities. By understanding these patterns, traders can make informed decisions about when to enter and exit markets. However, it is important to note that chart patterns are not foolproof and should be used in conjunction with other indicators and analysis tools. As with any type of trading, risk management is key, and traders should always use stop-loss orders and other risk management techniques to protect their capital.