Weekly News Recap 9 – 13 December 2024

News for 9 December 2024

Gold Volatile After U.S. Jobs Data Release

Towards the end of last week, gold prices fluctuated following the release of U.S. non-farm payrolls and the unemployment rate. The jobs data showed an increase of 227,000 jobs, and the unemployment rate was at 4.2%, which resulted in mixed signals, leaving the market direction uncertain.

It is expected that gold prices may recover slightly due to hopes of a Federal Reserve rate cut during the meeting scheduled for December 18-19, 2024.

U.S. Employment Increased by 227,000 Jobs in November, Exceeding Expectations

In November, U.S. non-farm payrolls rose by 227,000 jobs, surpassing analysts’ expectations of 202,000 jobs. This comes after a much smaller increase of just 36,000 jobs in October, which was impacted by Hurricane Helene and Milton, as well as strikes by Boeing employees that reduced job growth during that month.

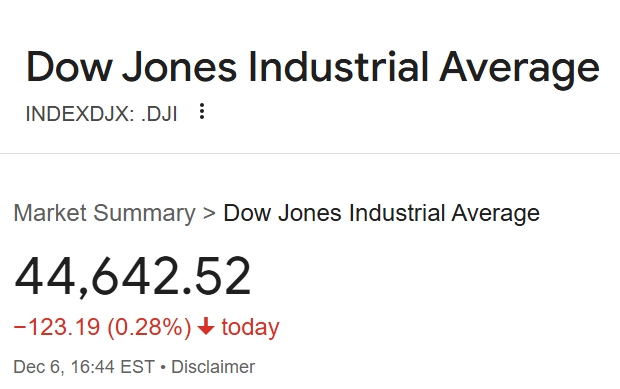

Dow Jones Drops, Nasdaq and S&P 500 Close at Record Highs Following U.S. Employment Data

The Dow Jones Industrial Average closed at 44,642.52, down by 123.19 points or -0.28%. The S&P 500 closed at 6,090.27, up by 15.16 points or +0.25%, while the Nasdaq finished at 19,859.77, gaining 159.05 points or +0.81%. The market was pressured by a 5.1% drop in UnitedHealth Group’s stock. However, both the Nasdaq and S&P 500 closed at record highs following the release of U.S. employment data, which suggested the Federal Reserve might consider cutting interest rates this month.

Meta Stock Jumps 2.4% After U.S. Appeals Court Supports TikTok Sale Law

Meta Platforms’ stock rose by 2.4% after the U.S. Appeals Court ruled in favor of a law that requires ByteDance, the parent company of TikTok, to sell the popular short-video app by early next year or face a potential ban in the United States.

Japan’s GDP for Q3 2024 Grows 1.2%, Beating Expectations

The Japanese Cabinet Office reported that the country’s GDP for the third quarter of 2024 grew by 1.2% year-on-year, surpassing the preliminary estimate of 0.9% and exceeding the 1.0% growth forecast by analysts in a Bloomberg survey.

Trump Confirms No Plans to Replace Fed Chair and Supports Investment in the U.S.

Donald Trump stated that he has no plans to replace Jerome Powell as the Chairman of the Federal Reserve when he officially takes office as President of the United States. He remarked, “I do not see the need to change the Fed Chair.” Additionally, he announced that his administration would expedite approval for investments from individuals or companies investing $1 billion or more in the U.S.

News for 11 December 2024

Gold Rebounds Strongly, Expectation of Fed Rate Cut Next Week

On December 10, gold prices rose to $2,694/oz, primarily due to expectations that the Federal Reserve will cut interest rates during next week’s meeting, along with increased buying of gold as a safe-haven asset amidst tensions in the Middle East.

On December 11, at 8:30 PM, the U.S. November inflation index will be announced, with a forecast of 2.7%.

It is assessed that U.S. inflation might rebound in the short term, which could lead to a reduction in expected interest rate cuts next year. For the day, gold prices are expected to range between $2,685 and $2,715/oz.

News for 12 December 2024

Gold Breaks Above Key Resistance, More Positive Outlook

On December 11, gold prices rose to close at $2,718/oz, mainly driven by the U.S. inflation data, which came in as expected at 2.7%. This reflects a trend of inflation that may not be as severe, leading to a more relaxed market sentiment and supporting expectations that the Federal Reserve may cut interest rates in next week’s meeting.

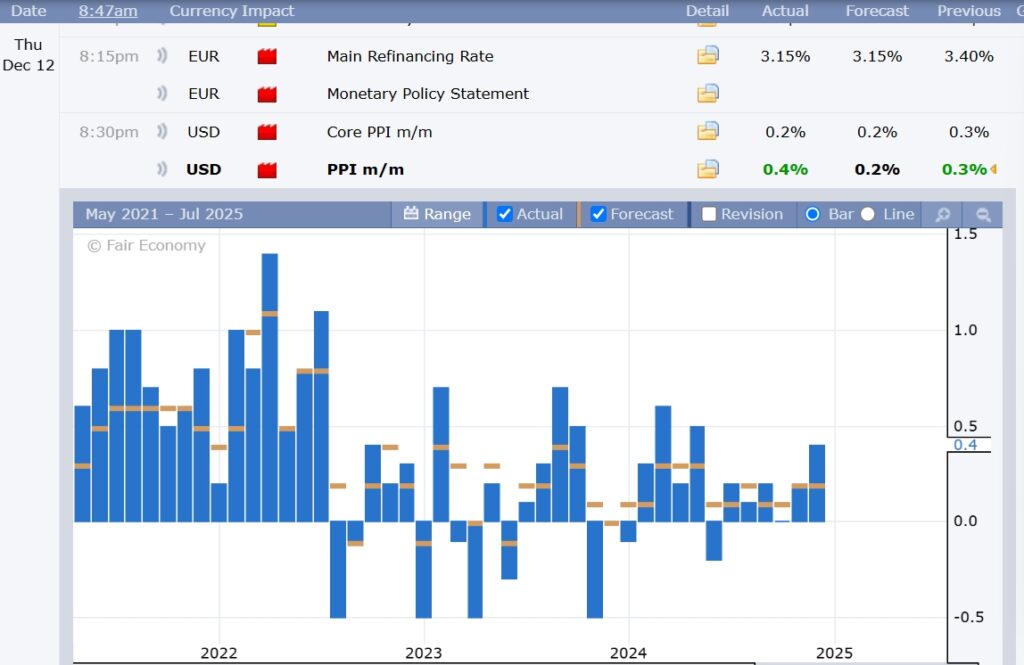

On December 12, at 8:30 PM, the U.S. Producer Price Index (PPI) will be announced, with a forecast of 0.2%.

Tesla Stock Surges 6%, Hits All-Time High After Trump’s Election Victory

Tesla’s stock rose nearly 6%, reaching a new all-time high, driven by the outlook that the company’s business will benefit from Donald Trump’s victory in the U.S. presidential election.

UnitedHealth Stock Drops After Proposed Legislation to Separate Pharmacy Business

UnitedHealth Group’s stock dropped after members of Congress from both the Democratic and Republican parties proposed legislation requiring companies that own health insurance or pharmacy benefit management businesses to separate their pharmacy operations within three years.

U.S. Treasury Secretary Warns of Strong Retaliation Against Currency Manipulation

U.S. Treasury Secretary Janet Yellen warned yesterday that the U.S. would respond strongly if any country attempts to manipulate its currency to gain a trade advantage. However, she confirmed that, at present, there has been no intervention in the markets in such a manner.

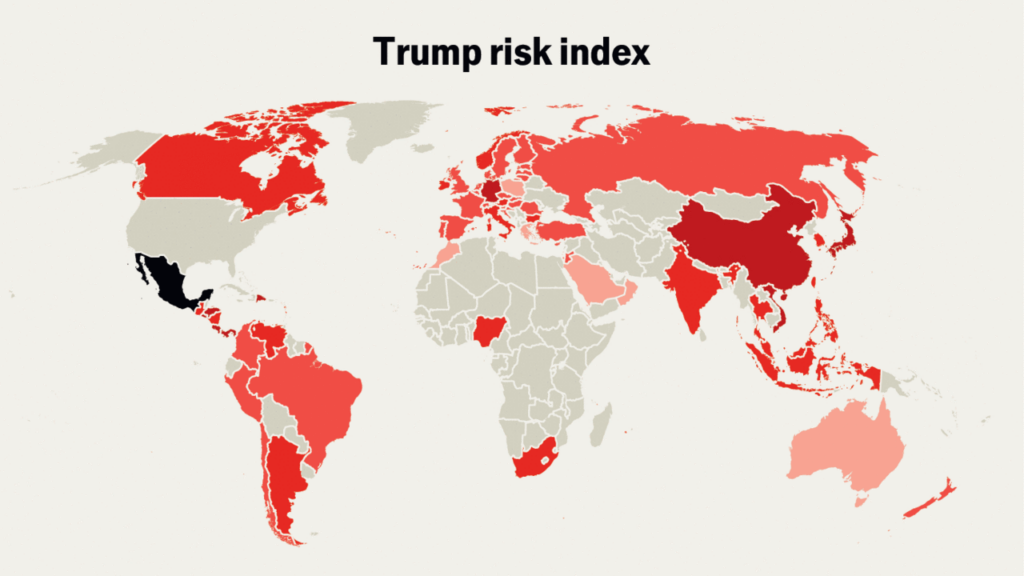

Trump Risk Index – Mexico and Thailand Most at Risk from New U.S. Tax Policies

The Information Technology and Innovation Foundation (ITIF) has released a new index called the Trump Risk Index, which ranks 39 U.S. allied countries based on their risk levels from new U.S. tax policies under President Donald Trump’s administration.

The rankings show that Mexico is at the highest risk (-4.12 points), followed by Thailand in second place (-3.98 points), the only Asian country in the top 10. Slovenia (-2.48), Austria (-2.42), and Canada (-1.98) are ranked 3rd to 5th. The negative scores reflect high levels of risk.

U.S. Government Raises Tariffs on Solar Products from China

The U.S. administration has announced an increase in import tariffs on solar products, including solar panels and polysilicon, from China. This move is seen as the final effort by the Biden administration to protect the U.S. clean technology industry and ensure its competitiveness against low-cost foreign products before President Biden’s term ends next month.

News for 13 December 2024

Gold Weakens After U.S. PPI Surges

On December 12, gold prices dropped to $2,680 per ounce following a higher-than-expected U.S. Producer Price Index (PPI) of 0.4%. This led to a stronger U.S. dollar, which pressured gold prices.

It is anticipated that gold may test the support level around $2,670/oz. If this support holds, a rebound is possible. However, if it breaks, the next support levels would be at $2,660/oz and $2,650/oz, respectively.

U.S. PPI Rises 3.0% in November, Exceeding Expectations

The U.S. Producer Price Index (PPI), a gauge of inflation from producer spending, surged 3.0% in November year-over-year. This marks the largest increase since February 2023 and surpassed analysts’ expectations of a 2.6% rise, following a 2.6% increase in October.

Warner Bros. Discovery Shares Jump 15.4%

Warner Bros. Discovery shares soared 15.4% after the company announced plans to separate its struggling cable TV business from its streaming and studio operations. This move is expected to drive future growth.

Japanese Manufacturer Confidence Index Rises for the First Time in Two Quarters

The Bank of Japan (BOJ) reported that the Tankan index, which measures the confidence of major manufacturers, increased to 14 in Q4 2024 from 13 in Q3 2024. This marks the first rise in the index in two quarters.

ECB Revises Down Eurozone Economic Growth Forecast

The European Central Bank (ECB) has once again lowered its growth forecast for the Eurozone economy. However, it maintains its outlook that inflation in the Eurozone will remain stable and within the target range of 2%.

UK GDP Contracts 0.1% in October, Below Expectations

The UK’s Gross Domestic Product (GDP) contracted by 0.1% in October, following the same decline in September. This result was below economists’ expectations, which had forecast a 0.1% expansion.