Weekly News Recap 18 – 22 November 2024

News for 18 November 2024

Gold Looks Set for a Rebound This Week

At the end of last week, gold prices rebounded and closed at $2,563/oz, supported by a weaker U.S. dollar, which dropped from 106.90 to 106.67. This situation has helped gold prices show signs of recovery.

For this week, gold prices are expected to continue rising, bolstered by the possibility of further weakening of the dollar. Additionally, U.S. President Joe Biden’s approval for Ukraine to strike Russia before the end of his term could drive more buying into safe-haven assets like gold.

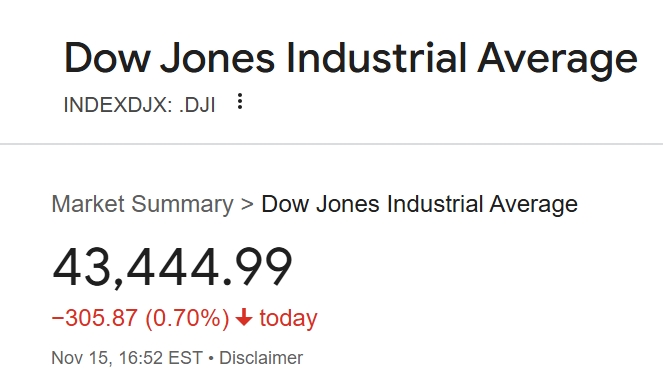

U.S. Stocks Drop! Dow Jones Falls 305 Points After Powell Signals Slower Rate Cuts

U.S. stock markets closed in the red, with the Dow Jones falling by 305.87 points (-0.70%) to close at 43,444.99 points. The S&P 500 ended at 5,870.62 points, down 78.55 points (-1.32%), and the Nasdaq closed at 18,680.12 points, falling 427.53 points (-2.24%).

The drop occurred after Jerome Powell, Chairman of the Federal Reserve, signaled that rate cuts could slow down, raising concerns among investors. Additionally, the market is closely monitoring the formation of the cabinet by Donald Trump, the incoming U.S. president, which may impact future economic and investment trends.

U.S. Vaccine and Food Packaging Stocks Drop!

Shares of vaccine and food packaging companies declined after Donald Trump revealed plans to nominate Robert F. Kennedy Jr., who has previously spread misinformation about vaccines and heavily criticized processed foods, as the head of the Department of Health and Human Services.

Shares of Moderna and Pfizer notably dropped, causing the healthcare sector index to hit its lowest level since May. This movement reflects investor concerns about the future direction of public health policies and the food industry under the new potential leadership.

BOJ Governor Signals Interest Rate Hike If Economic and Inflation Targets Are Met

Kazuo Ueda, the Governor of the Bank of Japan (BOJ), stated during a meeting with business leaders in Nagoya today that the central bank is ready to raise the policy interest rate from the current level of 0.25% if the economy and inflation move in line with BOJ’s forecasts.

This statement reflects the BOJ’s commitment to maintaining economic and financial stability amid rising inflationary pressures in the country.

Goldman Sachs Predicts Gold Prices Could Reach Record Highs Next Year

Goldman Sachs forecasts that gold prices are likely to surge to an all-time high in the coming year, driven by central bank buying and potential interest rate cuts by the U.S. Federal Reserve (Fed).

Goldman Sachs has ranked gold as one of the most attractive commodities to invest in for 2025, expecting prices to continue rising, especially during Donald Trump’s presidency, which could increase demand for safe-haven assets.

News for 19 November 2024

Gold Rebounds Above $2,600/oz After Dollar Weakens

On November 18, gold prices rose and closed at $2,611/oz, following a decline in the U.S. Dollar Index from 106.23 to 102.67, which supported gold’s upward movement.

On November 19 at 8:30 PM, the U.S. housing starts data will be released, with an expected figure of 1.44 million units.

For the near-term outlook, if gold prices decline but do not break below the $2,600/oz support level, there is still a chance for a rebound.

NVIDIA Q3 Earnings Expected to Jump 25% Due to Demand for New AI Chips

Investors are closely watching NVIDIA’s Q3 earnings, set to be released on Wednesday, November 20, as the company, a major producer of AI chips in the U.S., evaluates the demand for its new Blackwell AI chips, which are crucial to its future growth.

Analysts from BofA Global Research predict that NVIDIA’s earnings per share (EPS) in Q3 will increase by nearly 25%, reflecting strong demand in the continuously growing AI market.

Tesla Stock Jumps 5.6% Following Trump’s Autonomous Vehicle Policy Shift

Tesla’s stock surged 5.6% after Bloomberg reported that Donald Trump’s transition team is set to ease regulations on autonomous vehicles and prioritize the development of new frameworks for the U.S. Department of Transportation.

This move is a significant positive for Tesla, the leader in electric vehicle technology and autonomous driving systems, boosting investor confidence and driving the stock price higher.

US Officials Visit Lebanon for Ceasefire Talks, Gold Prices Under Pressure

Reuters reports that Amos Hochstein, the U.S. Special Coordinator for Ceasefire Negotiations between Israel and Hezbollah, is set to visit Beirut today. Lebanon is expected to respond positively to the U.S. ceasefire proposal.

This development has pressured gold prices, as a potential ceasefire could ease regional tensions. However, in the short term, investors continue to monitor the Dollar Index as a key factor in assessing gold price trends moving forward.

Trump to Attend SpaceX Rocket Launch, Highlighting Close Ties with Elon Musk

Donald Trump, the presumptive U.S. President, is expected to attend a SpaceX rocket launch in Texas today, underscoring the close relationship between him and Elon Musk, the billionaire founder and CEO of SpaceX.

Trump’s appearance at this key event could signal support for space technology during his administration, potentially providing significant momentum for the future of the aerospace industry.

News for 20 November 2024

Gold Rebounds After Dollar Weakens and Ukraine Launches Missiles into Russia

On November 19, gold prices rose, closing at $2,636/oz, driven by a continued decline in the Dollar Index from 106.25 to 106.15. Additionally, news of Ukraine launching missiles into Russian territory added to the upward pressure on gold prices.

Looking ahead, gold may test the $2,650/oz level if the conflict escalates further.

Walmart Stock Surges 3% to New High After Q3 Earnings Beat Expectations

Walmart, the world’s largest retailer, saw its stock rise by 3%, closing at $86.60, a new all-time high. This increase followed the release of better-than-expected third-quarter earnings and revenue.

Additionally, Walmart raised its annual sales and profit forecast for the third consecutive time, reflecting the strength of its business amidst a challenging economic environment, which bolstered investor confidence.

Google DeepMind Allocates $22 Million to Support AI Research

According to Xinhua News, Demis Hassabis, co-founder and CEO of Google DeepMind, announced that Google has allocated $20 million in cash along with $2 million in cloud credits for a new funding initiative.

The project aims to support scientists and researchers in using AI to make significant advancements in scientific progress. This initiative underscores Google’s commitment to leveraging technology for the benefit of humanity.

Dollar Stable at 154 Yen as Investors Buy Yen After Ukraine Attacks Russia

The U.S. dollar remained steady at 154 yen during morning trading in Tokyo today, after a slight dip earlier. The dollar’s decline was attributed to a surge in demand for the Japanese yen, seen as a safe-haven asset, following reports that Ukraine launched long-range missiles, made in the U.S., into Russian territory for the first time. This event prompted investors to shift their focus to low-risk assets to reduce market volatility.

News for 21 November 2024

Gold Breaks Above $2,650/oz as Dollar Weakens

On November 20, the price of gold rose to close at $2,650/oz, driven by a weakening U.S. dollar, which fell to 106.63, and news about Russia revising its nuclear weapons laws. This boosted gold, a safe-haven asset, as investors flocked to it for stability.

Additionally, on November 21 at 20:30, the U.S. will release its weekly initial jobless claims data, expected to be 220,000. This data may influence short-term market movements.

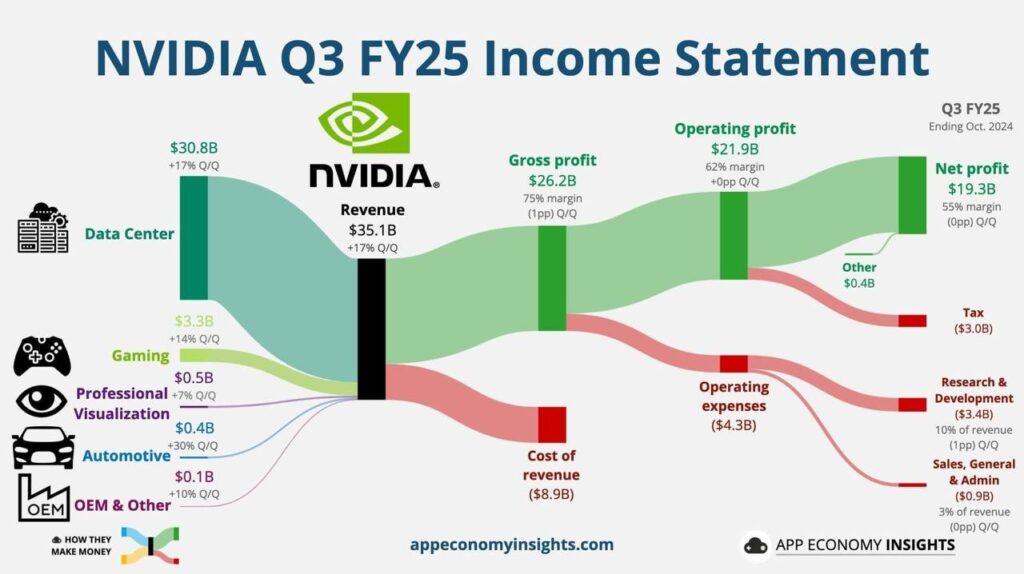

NVIDIA (NVDA) Stock Declines Slightly Despite Strong Q3 Earnings Report

NVIDIA’s Q3 earnings showed impressive growth, but its stock faced a slight decline. Here’s a breakdown of the highlights:

- Revenue: $35.1B (beat expectations of $33.1B), up 17% QoQ and 94% YoY.

- Non-GAAP EPS: $0.81 (beat expectations of $0.74), up 103% YoY.

- Gross Margin: 75.0% (beat expectations of 74.8%), up 0.6 percentage points YoY.

- Operating Income: $21.87B (beat expectations of $21.69B), up 17% QoQ and 110% YoY.

- Net Income: $19.31B, up 16% QoQ and 109% YoY.

Despite the robust growth in revenue and profit, NVIDIA’s stock faced slight pressure, which could be attributed to broader market conditions. On the positive side, the company is preparing to produce and deliver its new Blackwell chips, targeting the AI market, which is expected to drive future growth.

Shigeru Ishiba Hopes to Collaborate with Trump Rather than Clash

Japanese Prime Minister Shigeru Ishiba stated on November 19 that he hopes to collaborate with Donald Trump, the incoming U.S. president, rather than confront him. He emphasized that such cooperation would not only benefit both countries but also the broader Indo-Pacific region.

European Central Bank Warns of Risks from Trade Tensions and Slower Economic Growth

The European Central Bank (ECB) released its semi-annual financial stability review on November 19, highlighting that global trade tensions pose risks to the Eurozone economy. It also warned that weaker economic growth presents a greater threat than high inflation within the Eurozone, which comprises 20 member countries.

News for 22 November 2024

Gold Rebounds Strongly Amid Russia-Ukraine Tensions

On November 21, gold prices rose to $2,669/oz, driven by investor demand for safe-haven assets amid growing concerns over the Russia-Ukraine conflict.

On November 22 at 21:45, the U.S. will release its Manufacturing and Services PMI indices, with forecasts of 48.8 and 55.2, respectively.

From a technical perspective, gold is facing significant resistance at $2,675/oz. If prices manage to break through this level, there is potential to test the next resistance at $2,700/oz. However, if it fails to break this resistance, the key support level is at $2,650/oz.

Alphabet Shares Fall 4.7% After U.S. Justice Department’s Motion

Shares of Alphabet (Google’s parent company) dropped 4.7%, reaching a four-week low, following the U.S. Department of Justice filing a motion with the court to force Google to sell its Chrome browser and possibly its Android operating system to competitors. This action is aimed at addressing concerns about monopolistic practices in the online search industry. Such a move could have long-term implications for Google’s operations and market position.

Nvidia Shares Close 0.5% Higher After Positive Investor Sentiment on Earnings

Nvidia shares initially declined during the day but rebounded to close 0.5% higher, as investors became more optimistic about the company’s earnings report. Despite a slowdown in revenue for Q3 of fiscal year 2025, Nvidia’s performance exceeded analysts’ expectations. The company also projected higher-than-expected revenue for Q4, which boosted investor confidence in Nvidia’s stock.