Fundamental & Technical Analysis By Coach Mark RoboAcademy during 8 – 12 July 2024

Hello everyone, welcome to the weekly analysis of currency pairs EUR/USD, GBP/USD, and XAU/USD for the second week of July, from July 8-12, 2024.

EUR/USD, “Euro vs US Dollar”

Fundamental Analysis

Significant Economic Events Impacting EUR/USD This Week:

European Economic Data:

- Inflation Data: Monitor the Eurozone’s Consumer Price Index (CPI). If inflation is higher than expected, it could lead to expectations of tighter monetary policy, which would support the euro’s value.

- GDP Growth: The rate of GDP growth can provide insights into the overall health of the Eurozone economy. Strong GDP growth can support the euro’s value.

- Unemployment Rate: A lower unemployment rate indicates a strong economy, which would be positive for the euro.

U.S. Economic Data:

- Non-Farm Payrolls (NFP): The NFP report is a key economic indicator. Strong job creation can lead to expectations of tighter monetary policy from the Federal Reserve, which would support the dollar’s value.

- Inflation Data: The US CPI and Producer Price Index (PPI) data will be closely monitored. Higher inflation data can lead to expectations of interest rate hikes, which would be positive for the dollar.

- Retail Sales: Retail sales data can provide insights into consumer spending, a crucial component of the US economy.

Technical Analysis

Currently, the price has strongly held above the 1.08100 zone, indicating a short-term bullish outlook. One can wait for a correction to buy. Note the liquidity zone around the 1.08500 price. If price action occurs, look for an opportunity to enter an order with a target to test the upper resistance around 1.08800.

GBP/USD, “Great Britain Pound vs US Dollar”

Fundamental Analysis

Significant Economic Events Impacting GBP/USD This Week:

U.K. Economic Data:

- Inflation Data: Keep an eye on the UK’s Consumer Price Index (CPI). If inflation is higher than expected, it could lead to expectations of tighter monetary policy, which would support the pound’s value.

- GDP Growth: The rate of GDP growth can provide insights into the overall health of the UK economy. Strong GDP growth can support the pound’s value.

- Unemployment Rate: A lower unemployment rate indicates a strong economy, which would be positive for the pound’s value.

U.S. Economic Data:

- Non-Farm Payrolls (NFP): The NFP report is a key economic indicator. Strong job creation can lead to expectations of tighter monetary policy from the Federal Reserve, which would support the dollar’s value.

- Inflation Data: The US CPI and Producer Price Index (PPI) data will be closely monitored. Higher inflation data can lead to expectations of interest rate hikes, which would be positive for the dollar.

- Retail Sales: Retail sales data can provide insights into consumer spending, a crucial component of the US economy.

Technical Analysis

Currently, the price has risen strongly. Look for a correction to enter a buy position. Note the Fibo 0.618 zone at 1.27400. If the price retraces to this level, you can enter an order aiming to test the upper resistance at 1.28537-1.28610.

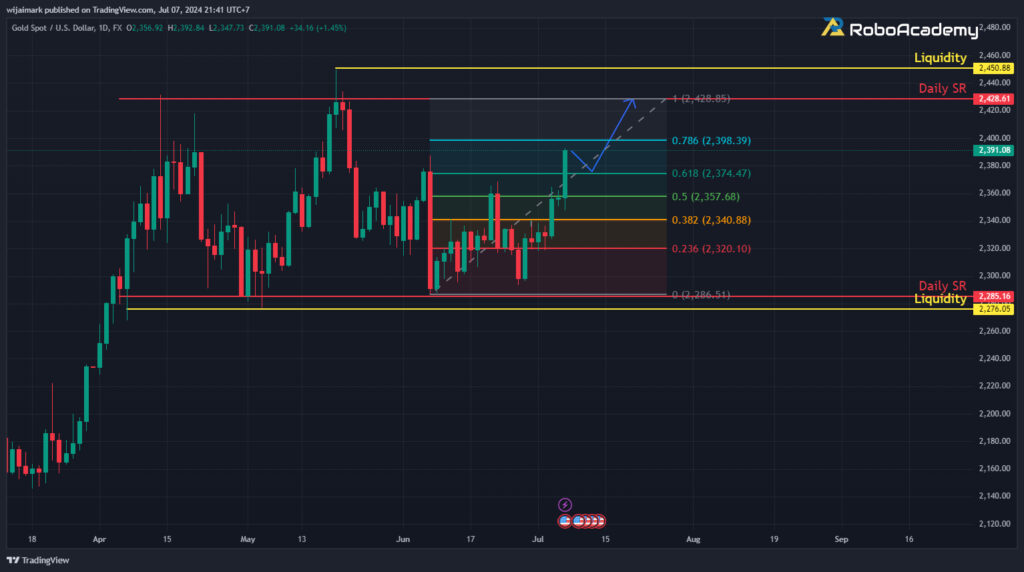

XAU/USD, “Gold vs US Dollar”

Fundamental Analysis

Significant Economic Events Impacting XAU/USD This Week:

U.S. Economic Data:

- Non-Farm Payrolls (NFP): The NFP report is a key economic indicator. Strong job creation can lead to expectations of tighter monetary policy from the Federal Reserve, which would be negative for gold prices.

- Inflation Data: The US CPI and Producer Price Index (PPI) data will be closely monitored. Higher inflation data can lead to expectations of interest rate hikes, which would negatively impact gold prices.

- Retail Sales: Retail sales data can provide insights into consumer spending, a crucial component of the US economy.

Other Factors Impacting Gold Prices:

- Supply and Demand: The global demand and supply of gold significantly impact its price. Key factors to monitor include gold production, gold trading, and central banks’ gold reserves.

- Inflation Rate: Gold is often seen as a safe-haven asset during high inflation periods. An increase in inflation can boost the demand for gold, driving its price up.

Technical Analysis

The price has shown a strong upward adjustment. Wait for a correction to enter a buy order or buy on a dip in a small timeframe to aim for a test of resistance around the price zone of approximately 2430-2450. Alternatively, if you prefer to wait for the price to retrace down to the Fibonacci 0.618 level (2374) and then enter a buy order, that’s also an option. Keep an eye on economic news or announcements that could impact prices throughout this week.

Disclaimer: This article is solely an analysis from the coach at RoboAcademy and is not intended as investment advice in any way. Investing is risky. Investors should study the information before making investment decisions.